Nigeria is set to launch a groundbreaking insurance scheme that will cover 11 million farmers from the risks of natural disasters such as drought, flood, locusts, cyclones and diseases. The scheme, which is a proposal to the National Economic Council (NEC), is part of the federal government’s efforts to revamp the agricultural sector and reduce dependence on food imports.

The scheme, dubbed Pula, is a programme for the development of parametric crop insurance through yield and weather index insurance. It will cover 22 crops such as maize, rice, wheat, cotton, cassava, soybeans and livestock. It will also involve over 100 distribution partners, 67 insurers and 22 global reinsurers.

The initiative has been successfully piloted across the country, covering different crops and regions. For instance, in the northern states of Adamawa, Bauchi, Borno, Gombe, Taraba and Yobe, rice, maize, wheat, cotton, cowpeas, soybeans and millet have been insured. In the South West, rice, maize, cotton, cassava and soybeans have been insured in Ekiti, Lagos, Ogun, Osun and Oyo.

The scheme is expected to boost the productivity and resilience of smallholder farmers and pastoralists, who constitute the majority of Nigeria’s rural population and contribute significantly to the nation’s food security and economic growth. According to the World Bank, agriculture accounts for about 23% of Nigeria’s GDP and employs about 40% of the labour force.

The scheme is also in line with the African Union’s Agenda 2063, which aims to transform the continent’s agriculture into a modern and profitable sector that guarantees food security and creates wealth. The scheme is supported by the African Development Bank (AfDB), which is spearheading the establishment of Specialised Agro Processing Zones (SAPZ) in Nigeria. The SAPZs are designed to attract private sector investments and create value addition in the agricultural sector.

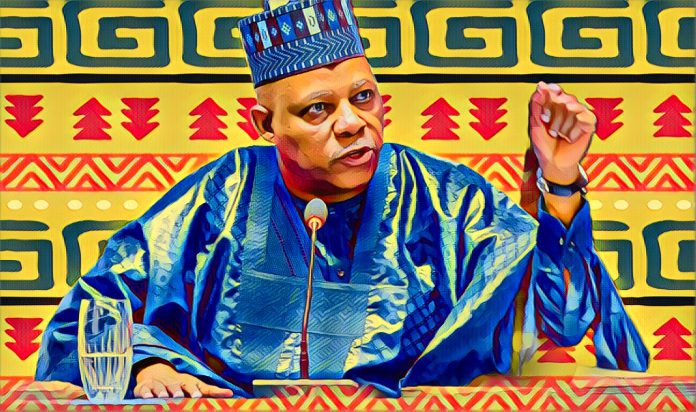

The Vice President of Nigeria, Kashim Shettima, who presided over the 137th meeting of the NEC, urged the governors of the 36 states of the federation to collaborate with the federal government and the AfDB in implementing the SAPZ programme. He also called for innovative capital pools from the private sector to help share and mitigate the fiscal and economic risks posed by natural disasters.

The proposal for the catastrophe insurance scheme was presented by the Ministry of Agriculture and Rural Development to the NEC, which is a statutory body that advises the President on the nation’s economic affairs. The NEC comprises the governors of the 36 states, the Governor of the Central Bank of Nigeria, the Minister of Finance and other stakeholders.

The scheme is yet to be approved by the NEC, but it has generated much interest and optimism among the stakeholders. If adopted, the scheme will be one of the first of its kind in Africa and will mark a milestone in the development of Nigeria’s agricultural sector.

Source: Business Day