Nigeria, Africa’s largest economy, has seen a sharp decline in foreign investment in the third quarter of 2023, according to the latest report by the National Bureau of Statistics (NBS). The report shows that total capital inflow into the country dropped by 36.5 percent to $654.7 million in Q3 from $1.03 billion in the previous quarter. It also fell by 43.6 percent from $1.16 billion in Q3 2022.

The NBS report reveals that other investments, which include loans, trade credits, and currency deposits, accounted for 77.6 percent ($507.6 million) of the total capital importation in Q3, followed by portfolio investment with 13.3 percent ($87.1 million) and foreign direct investment (FDI) with 9.13 percent ($59.8 million).

The low level of FDI, which reflects the long-term confidence of investors in the Nigerian economy, is a cause for concern as it indicates a lack of structural reforms and policy stability. FDI in Nigeria has been on a downward trend since 2014 when it peaked at $4.7 billion. In 2023, FDI is projected to reach only $240 million, the lowest since 2007, according to the World Bank.

The main sectors that attracted foreign investment in Q3 were production/manufacturing, which received $279.5 million (42.7 percent of the total), financing, which got $127.9 million (19.5 percent), and shares, which garnered $85.5 million (13.1 percent).

The top sources of capital inflow into Nigeria in Q3 were the Netherlands with $175.62 million (26.8 percent of the total), Singapore with $79.2 million (12.1 percent), and the United States with $67.0 million (10.2 percent).

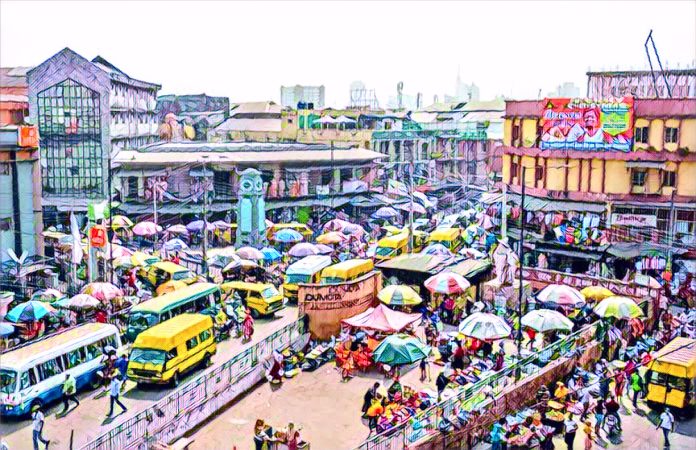

Lagos State remained the top destination for foreign investment in Q3 with $308.8 million (47.2 percent of the total), followed by Abuja (FCT) with $194.7 million (29.7 percent) and Abia state with $150.1 million (22.9 percent).

The leading banks that facilitated capital inflow into Nigeria in Q3 were Stanbic IBTC Bank Plc with $222.8 million (34.0 percent of the total), Citibank Nigeria Limited with $190.0 million (29.0 percent), and Zenith Bank Plc with $83.0 million (12.7 percent).

The decline in foreign investment in Nigeria reflects the impact of the global economic slowdown, the uncertainty caused by the COVID-19 pandemic, the security challenges in the country, the exchange rate volatility, the high inflation rate, the regulatory constraints, and the poor infrastructure.

However, some analysts believe that Nigeria has the potential to attract more foreign investment if it can address these challenges and implement reforms that will improve the business environment, diversify the economy, enhance governance and transparency, and foster regional integration.

The Nigerian government has recently launched several initiatives to boost foreign investment, such as the Economic Recovery and Growth Plan (ERGP), the Nigeria Investment Promotion Commission (NIPC) One Stop Investment Centre (OSIC), the Presidential Enabling Business Environment Council (PEBEC), and the African Continental Free Trade Area (AfCFTA) agreement.

These initiatives aim to create a more conducive climate for investment, promote key sectors such as agriculture, manufacturing, mining, and digital economy, simplify the processes and procedures for doing business, and expand the market access and opportunities for Nigerian products and services.

The NBS report also shows that Nigeria recorded a positive balance of payments of $2.3 billion in Q3, indicating that the country earned more foreign exchange than it spent. This was mainly due to the increase in oil prices and the recovery of oil production, which boosted the country’s exports and foreign reserves.

Nigeria, which relies heavily on oil for its revenue and foreign exchange, has been hit hard by the slump in oil prices and the disruption of oil output caused by the COVID-19 pandemic and the OPEC+ production cuts. However, the recent rebound in oil prices and the gradual easing of the OPEC+ quotas have given some relief to the country’s fiscal and external positions.

The NBS report is based on data from the Central Bank of Nigeria (CBN), which monitors and records the transactions of all financial institutions in Nigeria. The report covers the inflow and outflow of foreign capital across various sectors and types of investment.

Source: Leadership News