In preparation for the upcoming minimum wage negotiations, organized labour in Nigeria has announced plans to base its wage demands on the cost of living and other socio-economic indices across the country. This strategic move comes as the Federal Government promises to clear the arrears of the N35,000 wage award owed to its workers.

Sources reveal that labour groups have been diligently working to ensure that their wage demands are well-supported and difficult for both government and private sector employers to dispute. The Nigeria Labour Congress (NLC) has directed its state councils to gather data on living costs in towns and local government areas.

To support this data-driven approach, NLC has designed a form specifically for data collection at the local level. In a circular dated January 17, 2024, NLC’s General Secretary, Emmanuel Ugboaja, emphasized the importance of accurate data in negotiating a fair and equitable national minimum wage. The state councils have been urged to distribute the forms widely and submit the collated data to the national headquarters by the end of January 2024.

According to a report by Vanguard, Ugboaja encouraged the use of online platforms for efficient data collection, highlighting the urgency and significance of this task. He expressed confidence that, with collaborative efforts, the upcoming negotiations would be successful.

Meanwhile, the Minister of State for Labour and Employment, Nkeiruka Onyejeocha, reassured trade unions at meetings in Abuja that the government is committed to fulfilling its promises, including the payment of the N35,000 wage award. She confirmed that the government has started paying the award and assured that the outstanding amount would be cleared soon.

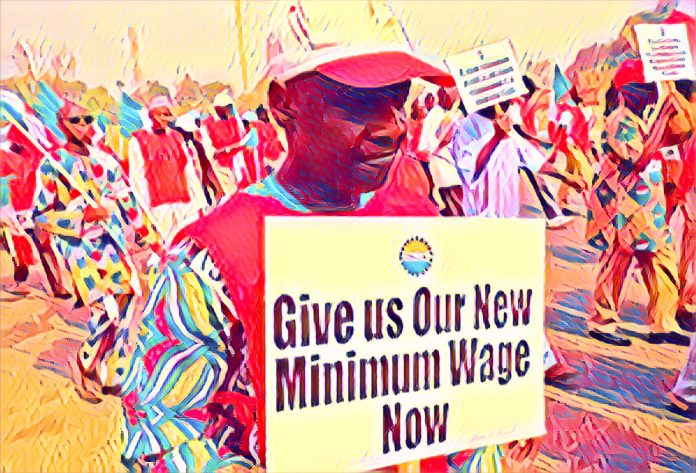

This development reflects the ongoing efforts by organised labour to advocate for fair wages based on current economic realities, as well as the government’s commitment to addressing the concerns of its workforce.