In a move to underscore the Nigerian government’s commitment to transparency and accountability within its financial sector, the House of Representatives has initiated a thorough investigation into the Central Bank of Nigeria’s (CBN) controversial cancellation of forward contracts valued at $2.4 billion. This probe, spearheaded by the House Committee on Small and Medium Enterprises (SMEs), aims to unravel the complexities behind the CBN’s decision, which has stirred significant discourse regarding the integrity and operational transparency of Nigeria’s apex bank.

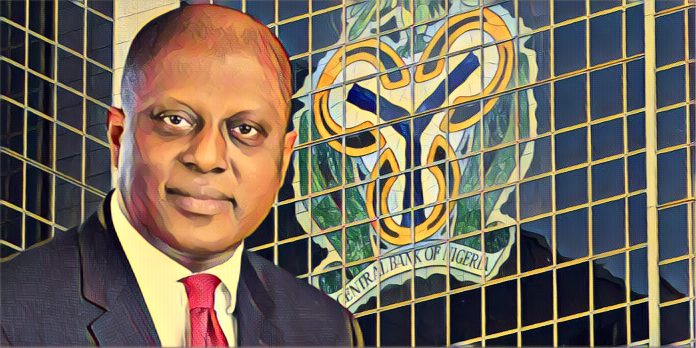

The controversy came to light following revelations by CBN Governor Olayemi Cardoso, who, during a session with the National Assembly, disclosed that an audit had uncovered about $2.4 billion in non-existent or fraudulent transactions within a $7 billion foreign exchange backlog. This backlog, encountered by Cardoso upon assuming office, was fraught with irregularities, including requests lacking proper import documentation and other dubious dealings. The audit, conducted by external consultants hired by the CBN, prompted this drastic course of action.

The House’s decision to investigate was catalyzed by a motion jointly sponsored by Representatives Zakaria Dauda Nyampa, Ojema Ojetu, and Obed Shehu. The motion calls for a detailed inquiry, inviting both the implicated manufacturing companies and Governor Cardoso to provide clarity on their transactions and to identify those businesses that were engaged in legitimate operations.

This scenario underscores a broader concern within the Nigerian financial landscape: the challenge of maintaining the balance between fostering economic growth and ensuring stringent regulatory compliance. The invalidated forward contracts, as detailed by Rep. Nyampa, were mechanisms originally designed to shield Nigerian manufacturing entities from the volatile swings in currency exchange rates, providing a semblance of financial stability for these firms. The unilateral cancellation of these contracts by the CBN, a year after their initiation, raises questions about the reliability of such financial safeguards and the potential repercussions for the affected companies, which had their accounts debited and were issued letters of credit based on these agreements.

Parallel to this investigation, the House Committee on Finance has been tasked with another significant probe into the allegations of tax evasion by MultiChoice, a leading multinational corporation operating within Nigeria. The motion, introduced by Rep. Sa’idu Abdullahi, alleges that MultiChoice has failed to remit over N1.8 trillion in taxes to the Nigerian government, an accusation that underscores potential revenue losses that could significantly impact the nation’s economy. This investigation seeks to uncover the truth behind these allegations, following unsuccessful attempts by the Federal Inland Revenue Service (FIRS) to recover these taxes through legal avenues and negotiations.

These investigations collectively reflect a broader mandate by the Nigerian legislature to enforce financial discipline, transparency, and accountability among both governmental and corporate entities operating within the country. By addressing these issues head-on, the House of Representatives demonstrates its commitment to safeguarding the economic interests of Nigeria, ensuring that all stakeholders adhere to the highest standards of financial integrity.

Moreover, these proceedings highlight the critical role of regulatory oversight in maintaining a stable and transparent financial environment conducive to economic growth and development. As these investigations unfold, they will undoubtedly shed light on the operational practices of the CBN and MultiChoice, potentially setting precedents for how similar cases are handled in the future.

DailyTrust recalls that the actions taken by the Nigerian House of Representatives signal a robust effort to address and rectify significant concerns within the nation’s financial and corporate sectors. Through these investigations, the government aims not only to uncover the truth behind these contentious issues but also to reinforce the principles of accountability and transparency that are essential for the health and stability of Nigeria’s economy. As these inquiries progress, they will undoubtedly contribute to the ongoing discourse on financial regulation and corporate governance in Nigeria, potentially ushering in reforms that will strengthen the nation’s financial systems against future irregularities.