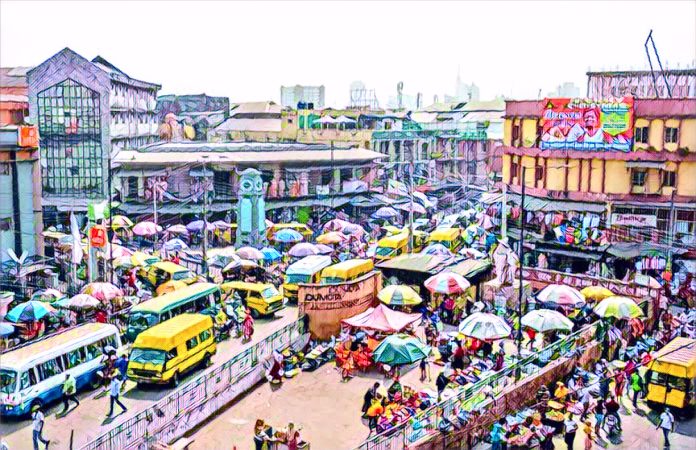

In a season of triple shocks, Nigerian families are battling to contain an escalating economic crisis. The most populous nation in Africa is grappling with climbing food prices, hikes in school fees, and over a 60 percent increment in house rent.

Nigeria’s inflation rate accelerated to 31.70 percent in February, driven by increasing food prices that have triggered a cost-of-living crisis. The International Monetary Fund recently warned that almost one in 10 people in Nigeria are facing food insecurity.

President Bola Tinubu launched a series of economic reforms, including the removal of fuel subsidies and liberalisation of currency controls. While these reforms were welcomed by foreign investors, they have been fuelling a cost-of-living crisis.

With food inflation, which constitutes 50 percent of the inflation rate, rising to 37.92 percent in February from 35.41 percent in January, the prices of stable foods such as garri, rice, beans, yam, bread, noodles, pasta, and eggs have more than doubled in recent time.

For instance, a paint bucket of yellow garri now sells for an average of N2,500 as against N1,200 sold in December 2023; a paint bucket of rice sells for over N6,500 while a medium-sized loaf of bread now sells for N1,200 from N750 this time last year and the biggest size sells for an average of N1,600.

In Nigeria today, people spend their salaries on three basic things of life including buying foodstuffs for the home, paying house rent and their children’s school fees as the rising economic pressure gives them no room to save for rainy days.

Despite these challenges, Nigerians remain hopeful. The resilience of the people is evident as they continue to navigate these economic hurdles. The spirit of endurance and the will to overcome are traits that define the Nigerian populace, and it is this spirit that will see them through these trying times.

Source: Businessday NG