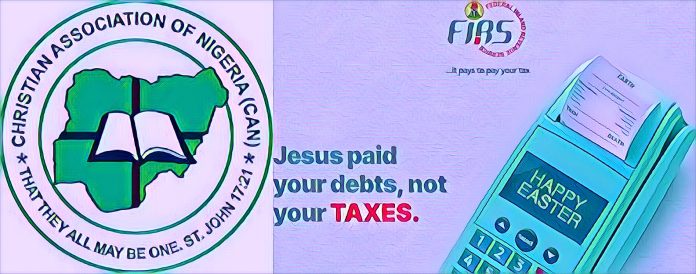

The Christian Association of Nigeria (CAN) has called for a public apology from the Federal Inland Revenue Service (FIRS) following an Easter advertisement that sparked controversy among the Christian community. The advert, which appeared on X (formerly known as Twitter) under the hashtag #FIRSNigeria, featured an image of a Point of Sale (PoS) machine alongside the caption, “Jesus paid your debts, not your taxes.” This message quickly drew criticism from various quarters, especially among Christians who found it offensive and disrespectful to their faith.

Despite the removal of the post, the incident has led to CAN’s National Director of National Issues and Social Welfare, Abimbola Ayuba, issuing a formal statement on Tuesday. The statement not only demands an apology from the FIRS but also calls upon the attention of President Bola Tinubu, Finance Minister Wale Edun, and the Department of State Services (DSS) to ensure such an incident does not recur. CAN emphasized the need for the FIRS and other public institutions to maintain a communication strategy that fosters respect, unity, and peace among Nigeria’s diverse religious communities.

The controversy arises at a time when religious harmony and peaceful coexistence are celebrated as national virtues in Nigeria, a country known for its religious diversity. CAN expressed its concern over the recurrence of messages that could be seen as provocative during religious holidays. The association highlighted that the Easter period, a significant time for reflection and observance among Christians, should not be marred by comparisons that trivialize or mock their religious beliefs.

CAN’s statement pointed out the inappropriate analogy drawn by the FIRS advertisement, which equated the Christian doctrine of redemption with the civic duty of tax payment. This comparison was met with widespread dismay and indignation from the Christian community, who felt that such messages could undermine the sanctity of their religious convictions.

Furthermore, CAN advised both public and private organizations to exercise greater caution and sensitivity towards Nigeria’s rich religious landscape. The association underscored the importance of crafting communications that are mindful of the nation’s cultural and religious diversity, especially when it comes from public entities expected to uphold standards of exemplary conduct.

This incident has opened up broader discussions on the responsibilities of public institutions in respecting and honoring the religious beliefs and practices of all citizens.