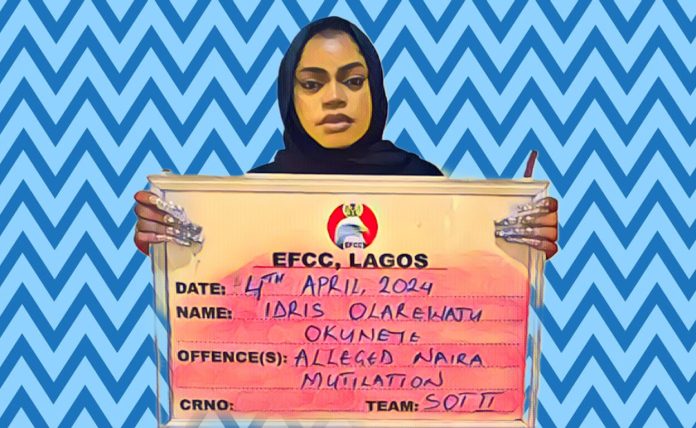

In a significant move underscoring the seriousness with which Nigeria’s Economic and Financial Crimes Commission (EFCC) addresses financial misdemeanors, controversial cross-dresser Idris Okuneye, popularly known as Bobrisky, has been arrested and detained for alleged abuse of the national currency. Bobrisky’s apprehension in Lagos on Wednesday night by the EFCC, over accusations including the spraying of naira notes and currency mutilation, has ignited discussions on the legal and societal implications of such acts.

Bobrisky, a figure often embroiled in media controversies, finds himself under the scrutiny of the EFCC following his actions at a recent movie premiere in Lagos, where he was reported to have flamboyantly flaunted and sprayed new naira notes. The premiere of “Ajakaju,” a film produced by Nollywood actress Eniola Ajao, at Film One Circle Mall in Lekki, became the focal point of the EFCC’s interest after video evidence of the incident circulated online.

EFCC spokesperson, Dele Oyewale, confirmed Bobrisky’s detention at the Lagos Command of the EFCC in a telephone interview, stating, “Bobrisky is with us. He was arrested last night in Lagos, and he is at our Lagos command. We arrested him for alleged abuse of naira notes, spraying of naira notes, and currency mutilation, among others. We are very serious about restoring the dignity of the naira. Though our investigation is still ongoing, but he will definitely be charged to court soon.”

The commission further emphasized its commitment to enforcing respect for the national currency through a statement titled “EFCC Grills Bobrisky for Naira Abuse,” shared on its social media handles. This statement elaborated on the investigations surrounding Bobrisky’s actions, not only at the movie premiere but also at various event centers and parties over time.

Bobrisky’s arrest raises pertinent questions about the enforcement of laws related to the handling of the Nigerian naira, a legal tender that holds symbolic and economic value for the nation. The Central Bank of Nigeria has long campaigned against the abuse of the naira, advocating for proper handling and respect for the currency in line with global best practices.

As the EFCC concludes its investigation and prepares to charge Bobrisky to court, the case highlights the broader efforts to maintain financial discipline and respect for the nation’s currency. It serves as a reminder of the legal obligations that accompany the use of the naira and the potential consequences of flouting these regulations.