Nigerian officials are stepping up efforts to tackle oil theft and pipeline vandalism in the Niger Delta region. This move comes as the country struggles to meet its 2024 oil production target, jeopardizing its budget and foreign exchange earnings.

Oil Theft Hinders Economic Growth

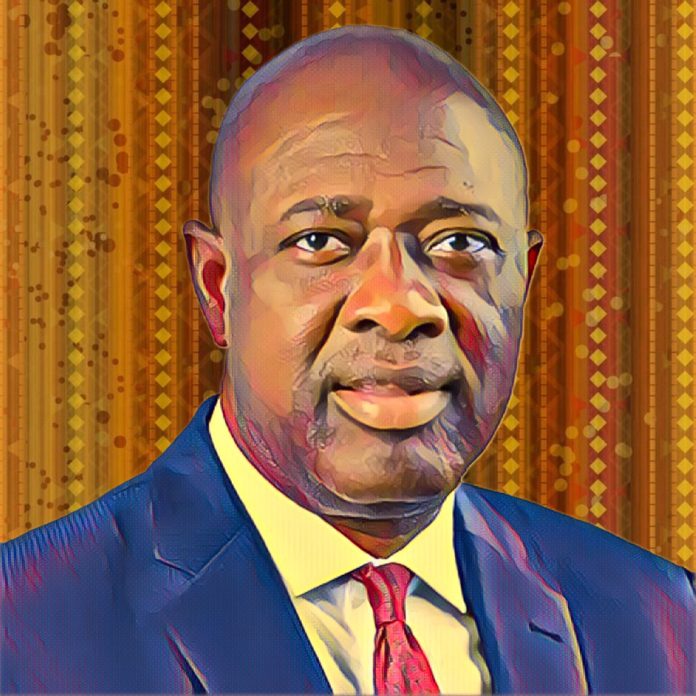

Senator Heineken Lokpobiri, the Minister of State Petroleum Resources (Oil), and Major General Christopher Musa, the Chief of Defence Staff, recently met in Abuja to discuss the issue. Both leaders acknowledged the significant impact of oil theft on the Nigerian economy. High oil prices, currently exceeding $90 per barrel, present a golden opportunity for Nigeria. However, continued pipeline vandalism and oil theft are hindering production and exportation, making it difficult for the country to capitalize on this favorable market situation.

Collaboration Between Government and Military

Lokpobiri emphasized the importance of the oil and gas sector to Nigeria’s economic well-being. He stressed that prioritizing security and investment in oil assets is crucial for all oil-producing nations. Lokpobiri pledged the ministry’s full support in working with the military to minimize pipeline vandalism and oil theft. His goal is to ensure Nigeria benefits from its oil and gas production.

“There is no country in the world that doesn’t prioritize security and investment in its oil assets. Our objectives are to reduce pipeline vandalism and oil theft to the barest minimum. We cannot eliminate it but working together with you will be able to reduce it to the barest minimum. So that we will be able to benefit from the production of oil and gas that is going on.

“Our commitment to you today is that we will work very closely with and we will give all the support that is needed to make sure that we reduce this menace of pipeline vandalism, illegal refining, and oil theft to the barest minimum”, he added.

Military Pledges Support

General Musa reaffirmed the military’s commitment to ending oil theft and pipeline vandalism in the Niger Delta. He acknowledged the challenges faced in the region, both directly and indirectly. Musa assured Lokpobiri and his ministry of the armed forces unwavering support. They aim to ensure Nigeria benefits from its natural resources.

While this joint effort by the government and military offers hope for increased oil production, challenges remain. Eliminating oil theft may not be possible. The success of this initiative hinges on the effectiveness of the implemented strategies and the ability to maintain a strong collaborative effort between all stakeholders

Source: Vanguard