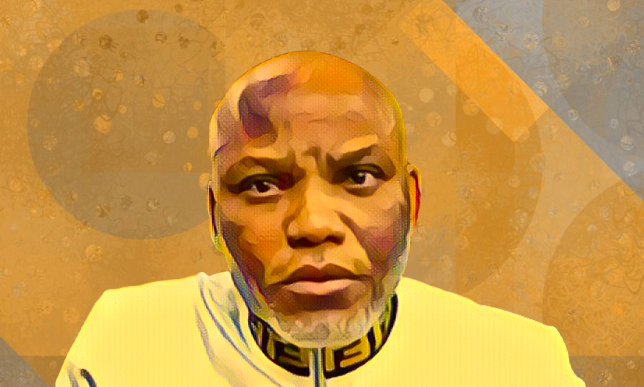

In a dramatic twist, Nnamdi Kanu, the leader of the Indigenous People of Biafra (IPOB), a group designated as a terrorist organization by the Nigerian government, offered to negotiate with the government to resolve the charges against him. His lawyers made the unexpected announcement during a court hearing on Wednesday in Abuja.

Kanu’s Legal Battles and Re-arrest

Kanu’s case has been a source of tension in Nigeria for years. He was first arrested in 2015 on charges of terrorism and treasonable felony for his role in advocating for the secession of Biafra, a region in southeastern Nigeria. After spending nearly two years in detention, he was released on bail in 2017. However, Kanu jumped bail in 2017 and fled the country. He was eventually re-arrested in Kenya in June 2021 and brought back to Nigeria to face trial.

The trial has been complex and contentious. In April 2022, eight of the original 15 charges against Kanu were dropped by the court. Then, in a major development, an appeals court ruling in October 2022 ordered Kanu’s immediate release, citing irregularities in his detention. The Nigerian government, however, challenged this decision and appealed to the Supreme Court. In December 2023, the Supreme Court sided with the government, vacating the appeals court’s decision and allowing the trial to proceed.

Negotiation Offer and Legal Maneuvering

During Wednesday’s hearing, Kanu’s lawyers presented a new strategy. They argued that Section 17 of the Federal High Court Act allows the court to promote reconciliation between parties in a case. They indicated that Kanu was open to exploring this option if the court dismissed their motions to dismiss the charges or challenge the court’s jurisdiction. These motions were separate attempts to have the case thrown out entirely.

The Nigerian government’s lawyer, however, presented a different perspective. He argued that negotiating with Kanu was beyond his authority and could only be pursued through the office of the Attorney General. The presiding judge acknowledged the limitations of the court’s role in mediating the situation. She made it clear that the court could not act as a negotiator but did not object to the possibility of negotiations happening outside the courtroom.

Uncertain Path Forward

The court’s decision to adjourn the trial until September 2024 leaves the future of the case uncertain. This delay allows time for further legal proceedings and, potentially, negotiations between Kanu and the Nigerian government. Whether such talks will materialize and, if so, whether they will lead to a resolution of the case, remains to be seen.

Kanu’s offer to negotiate suggests a possible shift in his strategy. It’s unclear if this is a genuine attempt to find a peaceful resolution or a tactical move to buy time. The Nigerian government’s response indicates a reluctance to engage in negotiations directly, but it leaves the door open for potential discussions through official channels.

Source: Vanguard