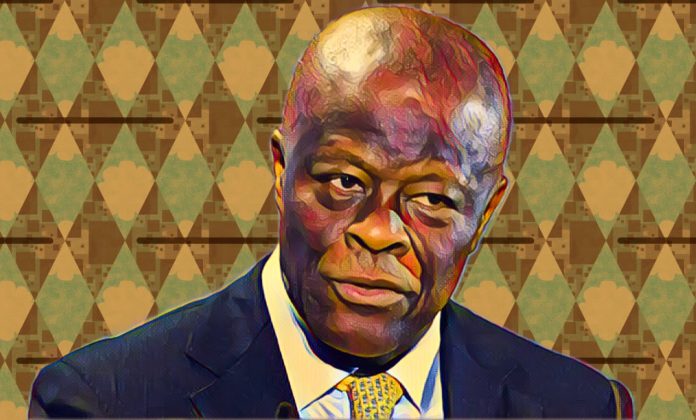

Federal Government is pursuing a $50 million loan from the World Bank to transform the power sector. This funding will support state governments in setting up solar plant pilots and upgrading infrastructure. The announcement came after a crucial meeting in Abuja between Wale Edun, Nigeria’s Minister of Finance and Coordinating Minister of the Economy, and a World Bank delegation led by Dr. Ndiamé Diop, the Country Director for Nigeria. Special Adviser to the President on Energy, Ms. Olu Verheijen, also attended the meeting.

The meeting, held on Monday, focused on innovative ways to advance Nigeria’s power sector. Edun emphasized the significance of the World Bank’s initiatives, including the Power Sector Recovery Operation and the Distribution Sector Recovery Programme. These programs aim to improve power distribution and management systems to foster economic growth and development.

Edun highlighted that part of the program includes rolling out 3.5 million prepaid meters to enhance power distribution. This move is expected to support tariff frameworks, market reforms, and co-financing the Transmission Company of Nigeria’s Performance Improvement Plan. The Minister’s statement, signed by Mohammed Manga, Director of Information and Public Relations for the Finance Ministry, underscored the Federal Government’s dedication to driving economic growth through power sector investments.

The government’s initiative aims to strengthen plans to deploy 3.5 million prepaid meters, thereby improving power distribution across the country. The $50 million funding will facilitate state solar plant pilots and necessary infrastructure upgrades. These measures will also support tariff frameworks, market reforms, and the co-financing of the Transmission Company of Nigeria’s Performance Improvement Plan.

This collaboration with the World Bank aims to boost Nigeria’s power sector, enhance energy access, promote economic growth, create jobs, and reduce poverty. These goals align with President Bola Tinubu’s Renewed Hope Agenda, which focuses on repositioning Nigeria’s economy for sustainable growth.

During the meeting, both Nigerian officials and the World Bank delegation reaffirmed their commitment to working together to achieve these objectives. The World Bank, known for its mission to reduce global poverty, provides loans and grants to developing countries for various projects, including infrastructure development, education, healthcare, and environmental sustainability.

Nigeria has been a significant recipient of loans from multilateral lenders. In 2023, the country borrowed $2.7 billion from international financial institutions, slightly down from $2.9 billion in 2022. This financial support has been crucial for Nigeria’s efforts to tackle economic challenges and implement development projects.

The Federal Government’s focus on solar energy and prepaid meters is part of a broader strategy to modernize the power infrastructure. Solar energy is seen as a sustainable and cost-effective solution to the country’s persistent electricity challenges. By investing in solar plant pilots, the government hopes to harness Nigeria’s abundant solar resources to provide reliable power to underserved areas.

The rollout of 3.5 million prepaid meters is another critical component of the government’s plan. Prepaid meters are expected to improve revenue collection for power companies and reduce electricity theft. This initiative will also empower consumers by giving them greater control over their electricity usage and expenditures.

The World Bank’s involvement in these projects highlights the international community’s support for Nigeria’s development goals. The collaboration aims to create a robust power sector that can drive economic growth and improve the quality of life for Nigerians.