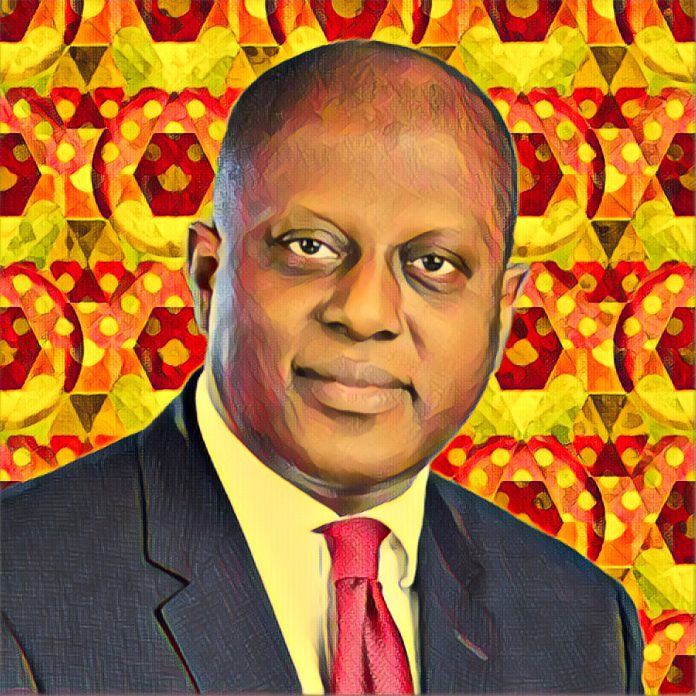

In response to public frustration over Nigeria’s economic challenges, Central Bank Governor Yemi Cardoso attributed the crisis to insufficient diversification, excess liquidity, and global economic pressure. He spoke at the conclusion of the Monetary Policy Committee (MPC)’s 296th meeting in Abuja.

To manage inflation, the MPC increased interest rates by 50 basis points from 26.25% to 26.75%. The apex bank also adjusted the asymmetric corridor from +100/-300 to +500/-100 basis points, maintained the Cash Reserve Ratio (CRR) at 45% for deposit money banks and 14% for merchant banks, and retained the Liquidity Ratio at 30%.

Cardoso justified these decisions by highlighting the detrimental impact of rising prices on households and businesses. He reiterated the MPC’s commitment to maintaining price stability. He expressed optimism that recent monetary policy measures, coupled with fiscal interventions aimed at addressing food inflation, would help stabilize prices in the near term.

Cardoso emphasized the persistent challenge of food inflation, worsened by insecurity in key agricultural areas and high transportation costs. He stressed the urgent need to enhance food supply within Nigeria.

“It was observed that while monetary policy has been moderating aggregate demand, rising food and energy costs continue to exert upward pressure on price development,” Cardoso said. “The prevailing insecurity in food-producing areas and high cost of transporting farm produce are also contributing to this trend.”

The MPC noted the increasing activities of middlemen who finance smallholder farmers, hoard farm produce, and move it across borders. To address this, the committee suggested measures to check such activities to moderate food prices in the Nigerian market.

The MPC resolved to sustain collaboration with fiscal authorities to subdue inflationary pressure. Cardoso highlighted that addressing these challenges would offer a sustainable solution to persistent food price pressures.

Nigeria’s first professor of capital markets, Uche Uwaleke, reacted to the MPC’s decisions. He predicted the 50 basis points increase and was pleased with the cautious approach. However, he expressed concern over the adjustment to the asymmetric corridor around the MPR.

“The adjustment to the asymmetric corridor around the MPR is a major source of concern,” Uwaleke said. “With an MPR of 26.75%, banks will get loans from the CBN at 31.75%, while they will be remunerated for their excess deposits at 25.75%. This will further squeeze liquidity from the banking system and jerk up the cost of credit, with adverse consequences on output and the equities market.”

Uwaleke also noted the lack of explanation in the MPC communique for increasing the SLR from +100 to +500 and the SDR from -300 to -100. He emphasized the importance of transparency in such decisions.

“Unlike previous MPC communiques, recent ones are silent regarding how the members voted. This information is useful even before their personal statements are published,” Uwaleke added.

Uwaleke underscored the role of fiscal policy in taming elevated inflation in Nigeria. He argued that non-monetary drivers of inflation, such as insecurity and high transportation costs, require fiscal interventions.

“As far as taming the current elevated inflation in Nigeria is concerned, the fiscal side holds the ace,” Uwaleke stated. He called for a coordinated effort between monetary and fiscal authorities to address the root causes of inflation and stabilize the economy.

The MPC’s recent decisions highlight the complexities of managing Nigeria’s economy amid global pressures and domestic challenges. By raising interest rates and adjusting key financial ratios, the CBN aims to control inflation and stabilize the market. However, experts like Uwaleke stress the need for transparency and collaboration between monetary and fiscal policies to achieve sustainable economic growth.