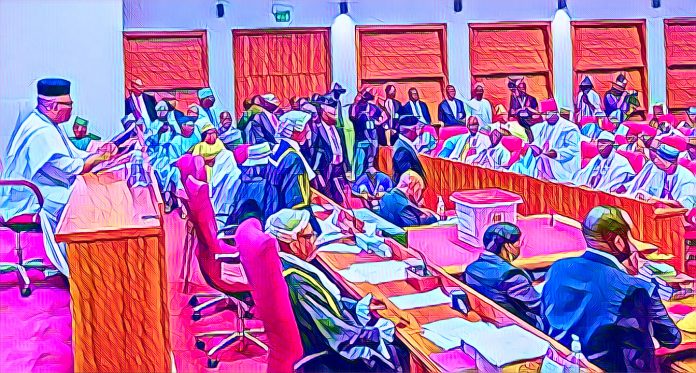

The Nigerian Senate has passed a bill amending the Finance Act of 2023 to impose a windfall tax on banks’ foreign exchange gains. Initially set at 50%, the Senate has increased the levy to 70%. This decision followed the third reading of the bill after the Senate considered the Finance Committee’s report during a plenary session.

The additional N6.2 trillion required by the Appropriation Amendment Bill will be financed by this one-time windfall tax on banks’ foreign exchange profits, as well as other independent revenue sources. The National Assembly approved these measures to meet the financial needs outlined in the amendment bill. Further amendments to the Finance Amendment Bill were presented by President Tinubu.

Initially, the bill proposed a 50% sharing formula on the profits realised from banks’ exchange transactions. However, the Senate decided to increase this to 70%. The rationale for this increase was that the windfall was not due to the banks’ effort or value addition but resulted from government policy. Therefore, the government argued that this surplus should be redistributed.

The Senate approved that the payment of this levy would take effect after the implementation of the new foreign exchange regime, extending to 2025 instead of starting in January 2024. Lawmakers pointed out that the initial proposal would have created a retrospective law, which they deemed inappropriate.

Another significant amendment involved the penalties for non-compliance. The original bill proposed a jail term of up to three years for principal officers of defaulting banks. However, the Senate has now removed this clause. Instead, any bank failing to pay the windfall levy to the Federal Inland Revenue Service (FIRS) and not executing a deferred payment agreement will face financial penalties. Specifically, such banks will be liable to pay the unpaid levy plus a fine of 10% of the withheld or unremitted levy per year. Additionally, interest will be charged at the prevailing Central Bank of Nigeria (CBN) Minimum Rediscount Rate (MMR).

The windfall tax targets profits that banks earn from fluctuations and gains in foreign exchange transactions. In recent times, Nigerian banks have reported substantial profits from these activities, driven largely by economic policies rather than their operational efficiencies. By taxing these profits more heavily, the government seeks to ensure a fair distribution of wealth generated through its policies.

Senate members argued that the increase from 50% to 70% was necessary to reflect the substantial gains banks have made without direct effort. This measure is seen as a way to harness these profits for public good, particularly in a time of economic need. The redistribution of these funds is expected to support public services and infrastructure projects, helping to address budget deficits and other financial challenges facing the nation.

The phased implementation of the new levy, starting with the new foreign exchange regime and extending to 2025, gives banks time to adjust to the new tax requirements. This phased approach aims to reduce potential financial shocks to the banking sector, providing a more manageable transition period.

The removal of the proposed jail terms for bank officers is also a notable change. By opting for financial penalties instead, the Senate has chosen a less punitive but still stringent approach to enforcing compliance. The financial penalties are designed to be substantial enough to deter non-compliance, ensuring that banks adhere to the new tax obligations.