Key Points

- Individuals can deposit U.S. dollars without taxes or penalties.

- The initiative supports stability in foreign exchange rates.

- The program targets reducing inflationary pressures on commodities.

The federal government announced Thursday a nine-month program, beginning Oct. 31, allowing individuals to deposit U.S. dollars held outside the formal banking system without scrutiny.

According to a report by The Punch, the initiative aims to address rising commodity costs influenced by foreign exchange rates driven by demand and supply dynamics, officials said.

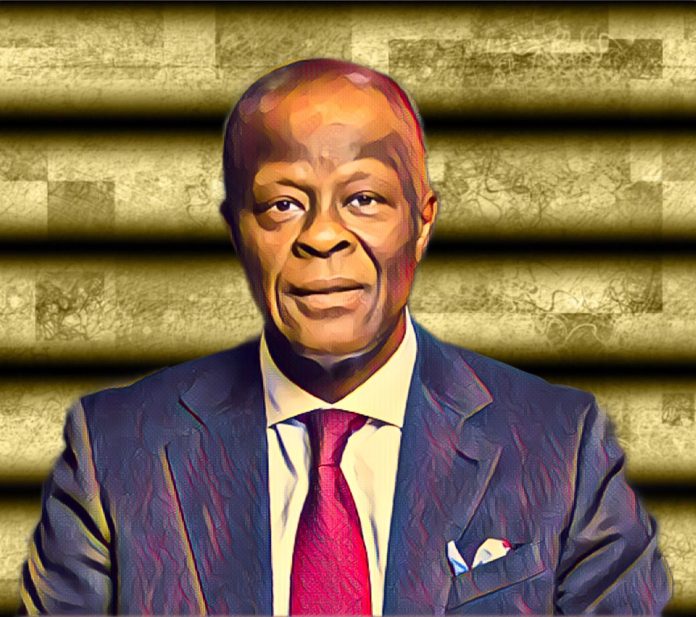

Finance Minister and Coordinating Minister of the Economy Wale Edun announced the program following the 144th meeting of the National Economic Council, chaired by Vice President Kashim Shettima at the State House in Abuja.

“There will be no penalty; there will be no taxes, and there will be no questions,” Edun told reporters after the council meeting.

Program aims to stabilize foreign exchange rates and reduce costs

Edun said the program allows individuals to bring in U.S. dollars in cash without facing penalties, taxes, or scrutiny, provided the funds are not linked to criminal or illicit activities. Participants will only need to meet standard bank Know-Your-Customer requirements to integrate the funds into the financial system for legitimate economic activities.

“One element of the cost increase is the foreign exchange rate, which is demand and supply driven,” Edun said. “This program will allow people to bring in cash outside the banking system.”

He noted that cash held outside the banking system is unsafe and insecure. The program provides a legal channel to deposit U.S. dollars, as long as the funds are not proceeds of crime.

“They just need to meet the standard Know-Your-Customer criteria at banks,” he said. “This offers a secure way to bring those funds into the financial system, where they can be used for regular economic activity.”

Individuals holding U.S. dollars outside banks encouraged to comply

Edun said his ministry will issue guidelines for the program, followed by additional guidance from the Central Bank of Nigeria.

The program offers law-abiding individuals a way to formalize their cash holdings, which may also strengthen the financial system by increasing dollar reserves and potentially stabilizing the exchange rate, Edun said.

“This is an opportunity for those wanting to comply with the law and for the country to benefit from the dollars moving into our financial system, contributing to our reserves and supporting exchange rate stability,” he said.

Edun also provided updates on economic relief measures, stating that 25 million Nigerians have benefitted from federal social protection initiatives, which include digital outreach, microenterprise loans, and targeted support for sectors such as power, agriculture, manufacturing, health, and compressed natural gas.