Key Points

- Nigeria targets FATF grey list exit by mid-2025.

- Ongoing reforms protect diaspora remittances and boost compliance.

- NFIU progress highlights significant strides in anti-money laundering.

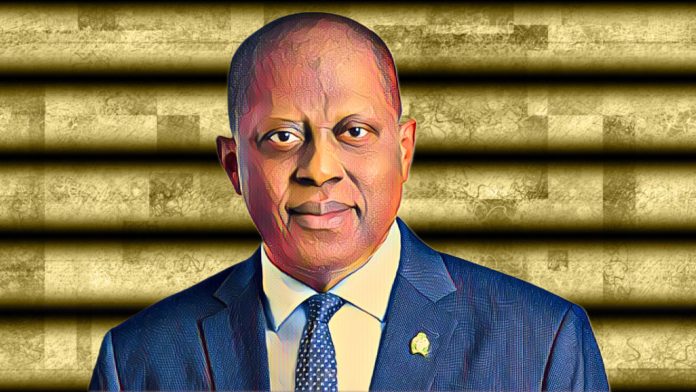

Following notable advancements in the fight against money laundering and terrorist financing, Nigeria may be removed off the Financial Action Task Force’s (FATF) grey list by the second quarter of 2025, according to Governor Olayemi Cardoso of the Central Bank of Nigeria (CBN).

Nigeria tackles FATF grey list with targeted reforms

Cardoso underlined the need to remove the list immediately, pointing to possible drawbacks, when briefing the media on the results of the Monetary Policy Committee meeting in Abuja on Tuesday. One of the CBN’s main goals is to impede Nigeria’s $1 billion monthly diaspora remittances.

Nigeria was placed on the FATF’s grey list in February 2023 because of flaws in its frameworks for counterterrorism financing (CFT) and anti-money laundering (AML).

Concerns about growing capital inflows and insufficient steps to combat financial crimes were the main factors in the decision.

Nigeria must put in place a thorough action plan to solve these problems within a predetermined timeframe in order to be removed from the grey list.

“Transactions like diaspora inflows become more suspicious to regulators worldwide if Nigeria stays on the FATF grey list,” Cardoso said. “We’ve planned the entire process to make sure we get off that list because we don’t want anything that will send bad signals across the waves.”

International collaboration key to improving Nigeria’s financial standing

Increased stakeholder participation, improved regulatory frameworks, and the imposition of fines where required are among the initiatives.

According to business day in order to better conform to FATF norms and ancillary bodies, authorities are also stepping up international cooperation. “With these efforts in mind, we honestly expect to be removed from the FATF grey list by the second quarter of 2025,” Cardoso said.

The Nigerian Financial Intelligence Unit (NFIU), which recently declared that Nigeria received “Compliant” or “Largely Compliant” ratings in 37 of the 40 FATF recommendations, emphasized the progress.

The 42nd conference of the ECOWAS Inter-Governmental Group Against Money Laundering in West Africa (GIABA), which was recently held in Freetown, Sierra Leone, acknowledged this success.