KEY POINTS

- To curb inflation CBN increases Monetary Policy Rate to 27.5 percent.

- Deposit money banks now have to retain 50 percent of their cash in the banks’ cash reserves.

- Structural and energy cost pressures mean that core inflation remains a concern.

According to the Central Bank of Nigeria (CBN), it will increase the monetary policy rate (MPR) by 25 basis points to 27.5 percent from 27.25 percent in September last year.

Monetary policy tightened in CBN over rising inflation

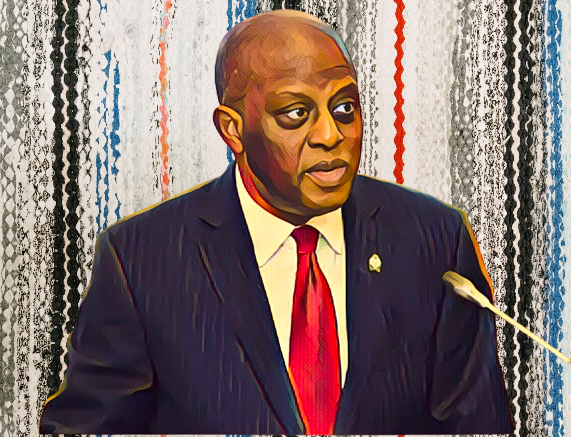

Responding to the decision after Abuja’s 298th Monetary Policy Committee (MPC) meeting, CBN Governor Olayemi Cardoso said the bank was trying to tame inflation, which stood at 33.87 percent in October 2024.

Cardoso said in the briefing: “The committee unanimously agreed to raise the rate to tackle ongoing inflationary pressures.”

Retained measures and policy adjustments

In addition to the MPR adjustment, the MPC made other monetary decisions:

– Cash Reserve Ratio (CRR): Deposit money banks increased to 50 percent from 45 percent while merchant banks rose to 16 percent from 14 percent.

– Liquidity Ratio: Retained at 30 percent.

– Asymmetric Corridor: Kept at +500/-100 basis points away from MPR.

The committee’s focus is on the inflationary pressures generated by core factors, such as energy costs, fiscal deficits and money supply growth, Cardoso said.

The MPC raised the MPR by 50 basis points in similar concerns at its September meeting.

Headline inflation was much as expected and edged down slightly from August, while core inflation was still high and underlined structural challenges in the economy.

Impact on the Economy

Like the adjustment in interest rates is expected to stabilise Nigeria’s macroeconomic environment although business and individual borrowing cost will in turn increase.

The CBN is trying to rein in inflation and safeguard long term economic stability by tightening monetary policy.

However, persistent structural factors such as high energy costs or disruptions in supply chains will keep putting pressure on prices, analysts warn.

It shows the CBN’s embrace of aligning monetary policy to fight inflation.