KEY POINTS

- Due to outdated systems, banks aren’t reflecting NIN modifications.

- The greatest problems are experienced by married women or those with name changes.

- It takes Nigerians so much time and money to fix the problem.

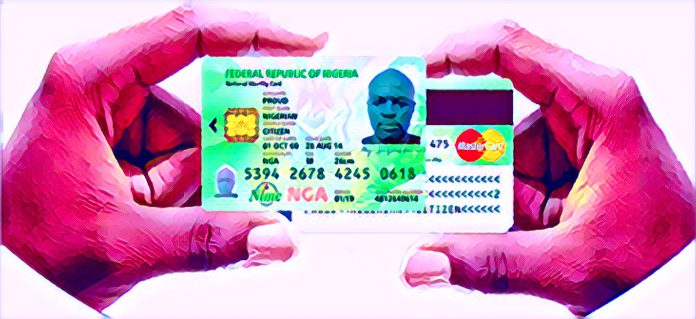

There have been delays and errors on modification of National Identity Number (NIN) for Nigerians.

For instance, bank customers who have reflected their changes in the details such as name, date of birth and gender on the NIMC Self service NIN modification portal have not succeeded in updating their details on the bank accounts.

Vanguard spoke with customers who recounted how they had experienced repeated instances, where changes on the NIMC portal did not reflect in their bank details. In particular, it has hit married women, who are struggling to change their maiden names to their married ones.

Others also complained that their NIN profile was showing errors after the changes they made on the portal.

However, the banks blame the National Identity Management Commission (NIMC) for the issues but the NIMC has maintained that the banks are still using old systems.

NIMC said its verification and authentication systems are working okay, but banks need to update their portals to accommodate the modified data.

The struggle for correct data: a tale of two systems

The disconnect between the online version contained at the NIMC’s updated portal and the NIMC’s outdated systems is at the heart of the NIN modification issue.

Findings also showed customers who changed their details through the NIMC Self-service NIN modification portal, were still having their old profiles active in banking systems.

Some frustrated customers from the Uvwie Local Government Area, Delta State, also said that the modification was visible on the NIMC portal but their bank profiles remained unchanged.

According to an NIMC official in the area, banks were still using an ‘old server’ and advised that they were ‘doing what the Nigerian Immigration Service is doing which is updating the system.’

Defending the agency, Kayode Adegoke, NIMC Director Corporate Affairs, said their verification services are working fine. He added that one can escalate any verification issue to NIMC for prompt resolution. But for a lot of Nigerians, it’s still frustrating, because their personal data is still not in sync across every system.

A calling for faster solutions

Mrs. Amaka from Lagos and Mrs. Fadekemi Shodipe, a trader, had spent months in vain trying to resolve discrepancies complained affected customers. They showed up at the NIMC office, paid their fees and were informed the modifications were done, only to return to the banks and discover the changes were not reflected.

Some even shared their bitter journey of time and money spent, some paying up to N10,000 for helping with addressing the problem. Mrs. Bimbo Adams, another Lagos resident, summed up the frustration felt by many: ‘The government should call NIMC and the banks to sit down and hammer this thing out once and for all,’ ‘he said.

As someone fortunate enough to live in a society where things supposedly function efficiently, these problems shouldn’t persist.”