KEY POINTS

- Macroeconomic issues and policy gaps limit capital market growth.

- Sukuk bonds finance key infrastructure projects across Nigeria.

- SEC calls for policy reforms and stronger investor participation.

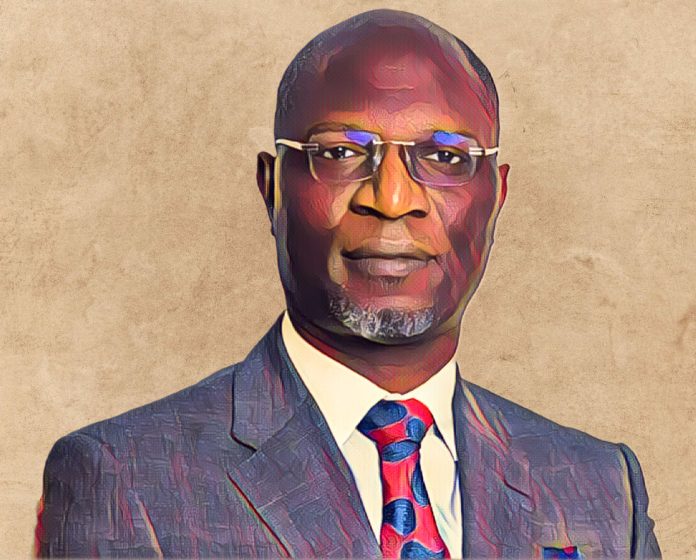

The Director-General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, says Nigeria’s capital market is being hindered by macroeconomic uncertainties, regulatory bottlenecks, and limited investor participation.

Speaking at the 2024 SEC Journalists Academy in Lagos, Agama stressed the urgent need for reform to unlock the market’s full potential.

He highlighted that a thriving capital market is essential to Nigeria’s journey toward achieving its goal of becoming a $1 trillion economy.

“Achieving a $1 trillion economy is not merely an aspirational goal; it is a necessity for the prosperity and resilience of Nigeria,” Agama stated.

He emphasized that the capital market serves as the financial backbone of the country’s economy and plays a vital role in driving growth and development.

Despite its potential, the market faces constraints that limit its contribution to economic transformation. Agama pointed out that for Nigeria to hit its $1 trillion economy target, issues like regulatory bottlenecks, macroeconomic instability, and investor apathy must be addressed.

Investor participation and policy reforms key to growth

Agama called for a concerted effort from policymakers, businesses, and other stakeholders to foster an environment that supports capital market growth. He urged policymakers to establish better regulatory frameworks that would attract both local and foreign investors.

“Addressing these constraints will unlock the full potential of the capital market in achieving Nigeria’s $1 trillion economy target,” Agama noted.

According to Punch, he added that despite the challenges, the capital market had already made significant contributions to Nigeria’s economy, especially in financing key infrastructure projects.

He cited the issuance of Sukuk bonds as an example of how the market has facilitated government projects. The Federal Government has used funds from Sukuk bond offerings to finance major road projects across the country’s six geopolitical zones.

This initiative, he said, has reduced Nigeria’s reliance on external borrowing, created jobs, and improved logistics and transport infrastructure.

Call for stakeholder action to boost capital market growth

To accelerate Nigeria’s journey to a $1 trillion economy, Agama urged businesses to explore the vast opportunities within the capital market.

He highlighted the role of the media in educating the public on the importance of the capital market in driving national growth and development.

According to Agama, improving public awareness would boost investor confidence and encourage greater market participation. He called on businesses to take advantage of available market opportunities to raise funds for expansion and growth.

He also encouraged policymakers to develop initiatives that would reduce regulatory burdens and enhance transparency within the market.

Addressing these issues, he explained, would boost Nigeria’s economic transformation agenda and attract more investment into critical sectors.

“Ultimately, the future of Nigeria’s capital market depends on the active participation of stakeholders, policymakers, and businesses,” Agama said.