KEY POINTS

-

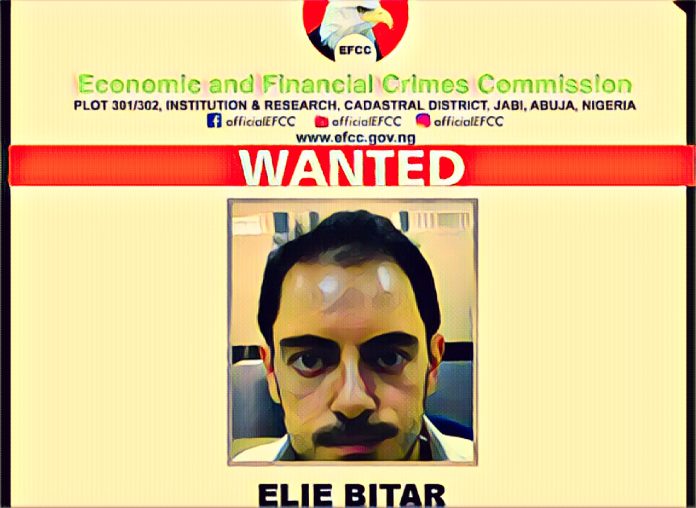

The EFCC seeks Elie Bitar, alleged mastermind of the CBEX Ponzi scheme, following earlier warrants for four promoters tied to ₦12 billion ($15 million) investor losses.

-

Osun State’s public broadcaster, OSBC, faces scrutiny for promoting CBEX as a poverty-alleviation program, amplifying the scheme’s reach and credibility.

-

Over 8,000 Nigerians, including students and low-income traders, were defrauded, highlighting systemic vulnerabilities to crypto scams amid economic hardship.

The Economic and Financial Crimes Commission (EFCC) is working harder to stop cryptocurrency-related fraud linked to the failed Crypto Bridge Exchange (CBEX), which officials say was a complex Ponzi scheme that stole billions of naira from thousands of Nigerians.

In recent times, Lebanese-Nigerian businessman Elie Bitar previously named as the alleged mastermind behind a fraud case. However, in recent development, the EFCC has removed him its wanted list after new evidence emerged, clearing him of involvement in the scandal.

EFCC is going after eight main suspects in the CBEX scandal

The EFCC is currently looking into eight other people who are thought to have planned the fall of CBEX. Seyi Oloyede, Emmanuel Uko, Adefowora Oluwanisola, Adefowora Abiodun Olanipekun, Johnson Okiroh Ofienolu, Israel Mbalika, Joseph Michiro Kabera, and Serah Michiro are all suspects.

Dele Oyewale, a spokesperson for the EFCC, said that the agency is working with international law enforcement partners to find and arrest the suspects. Oyewale said, “The Commission will not stop until every person involved in the fraudulent dealings is brought to justice.” This shows how serious the investigation is.

The CBEX scam has hurt Nigeria’s economy badly, costing more than 8,000 investors their savings. Victims like university student Amina Lawal have told heartbreaking stories. She lost ₦2.7 million that was supposed to pay for her tuition after trusting CBEX because it was advertised on the Osun State Broadcasting Corporation (OSBC).

State-run TV pushes CBEX during a crackdown

Investigations showed that in 2024, the OSBC aired shows that made CBEX look like a “poverty alleviation” program supported by the government. A representative from CBEX promised riches to “market traders and herbal sellers” during one broadcast. At the same time, an OSBC host told listeners to join without checking to see if the platform was real.

Tunde Oke, a financial analyst, said that Nigeria’s weak economy and high youth unemployment rate—35 percent—have made many people easy targets for quick-profit schemes like CBEX. Oke said, “Nigerians are open to unregulated platforms because they want quick gains.”

The Central Bank of Nigeria (CBN) has warned people many times not to invest in unlicensed cryptocurrencies, but it is still hard to enforce these rules, which lets scams thrive.