KEY POINTS

- Disbursement set to begin before end of 2025.

- Loans range from N5,000 to N100,000, interest-free and collateral-free.

- Pilot phase to cover farmers in poultry, aquaculture, livestock, and crop production.

The Federal Government will begin rolling out interest-free loans for smallholder farmers and micro-businesses before the end of 2025, according to Hamza Ibrahim Baba, National Programme Manager of the Government Enterprise and Empowerment Programme (GEEP).

Speaking in Kaduna on Friday during an engagement with traders’ associations and informal business stakeholders, Baba said the pilot phase would target farmers across the country, including those in Kaduna State. The loans, ranging from N5,000 to N100,000, will be disbursed under the FarmerMoni scheme, one of GEEP’s flagship initiatives.

Support for farmers and small enterprises

Beneficiaries will be granted a six-month moratorium before repayment begins, giving them time to scale production. Funds can be used to purchase fertilisers, livestock, veterinary drugs, and other critical inputs.

“These are not grants. They are loans but interest-free,” Baba said, stressing that the initiative aims to help farmers and micro-entrepreneurs improve productivity, enter the formal financial system, and eventually create jobs.

Broader poverty alleviation push

GEEP, domiciled under the Ministry of Humanitarian Affairs and Poverty Alleviation, is one of the key components of the National Social Investment Programme. It offers collateral-free loans under three schemes:

TraderMoni, targeting youths in petty trading;

MarketMoni, focused on women in small-scale trading;

FarmerMoni, designed for rural farmers.

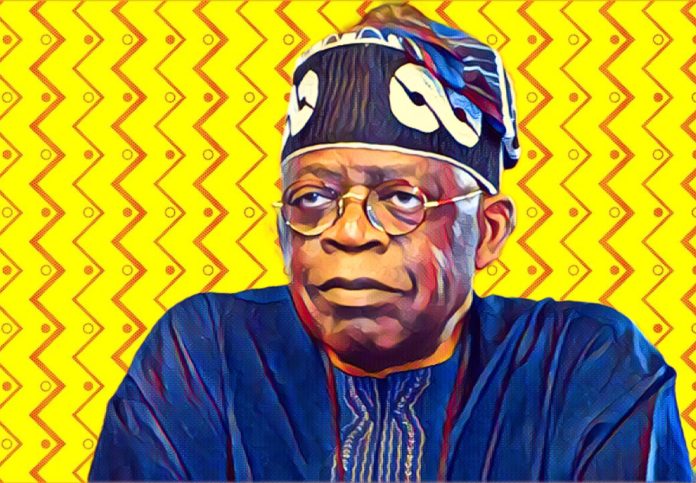

Baba also said the Tinubu administration would expand GEEP’s reach, using the 2025 pilot to lay the groundwork for a broader rollout in 2026.

Calls for transparency

He urged traders’ associations and cooperatives to work with GEEP desk officers across all 774 local governments to ensure transparent selection of beneficiaries.

“The success of this programme depends on transparency and proper targeting. We want to reach those who truly need support, not those looking to take advantage of the system,” Baba said.

Reactions from beneficiaries

Hauwa Musa, a trader, said previous support from GEEP had helped expand her business and welcomed the fresh initiative. Another stakeholder, Mallam Umar Usman, said he hoped to benefit from the upcoming GEEP 3.0 phase.

Finally market leaders commended the government’s intervention, pledging to cooperate with field officers to ensure the loans reach deserving recipients.