KEY POINTS

- Dangote net worth dipped below $29 billion.

- A sell-off in cement stock drove $549m loss.

- Furthermore private assets shield much of his wealth.

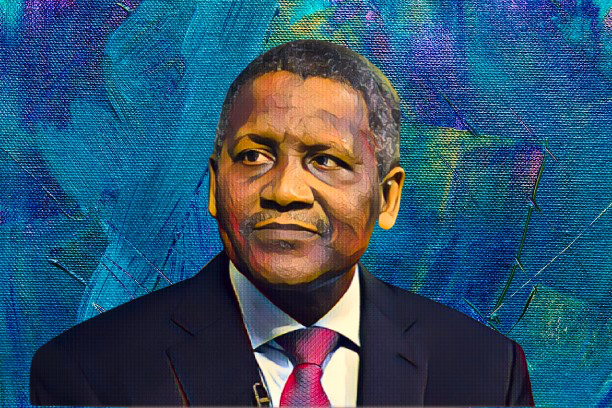

Just two weeks after optimism swelled that Africa could soon boast its first $30-billion man, Aliko Dangote’s wealth has taken a sharp hit.

The Nigerian billionaire shed $549 million in a single day, dragging his net worth below $29 billion for the first time since early August.

Bloomberg data shows that Dangote, who stepped down as chairman of Dangote Cement Plc to focus on his $20 billion oil and petrochemical complex, saw most of his losses tied to market turbulence in his cement empire. At the start of trading on August 19, his fortune stood at $29.3 billion. By day’s end, therefore it had slipped to $28.7 billion.

Africa’s richest man faces market setback

The rout stemmed from a heavy sell-off in Dangote Cement, Africa’s biggest cement producer. Investors dumped nearly 2.6 million shares worth N1.35 billion ($0.88 million) on the Nigerian Exchange in Lagos, sending the stock down 9.88 percent in a single session. The slump cut the value of Dangote’s cement stake from $5.4 billion to $4.96 billion.

Dangote net worth dip follows brief rally

The decline comes weeks after a short rally that briefly pushed his fortune from $28.8 billion to $29.3 billion, further putting him within touching distance of the symbolic $30 billion mark. Despite the setback, Dangote remains one of Africa’s top gainers in 2025. His net worth is still up $659 million for the year, down from a $1.2 billion gain just days earlier.

Dangote net worth supported by private assets

Most of his fortune remains anchored in privately held businesses, untouched by the week’s market slump. His $18.6 billion stake in the Dangote refinery, which began operations in 2024, has also held steady, alongside his $3.02 billion fertilizer unit.

He also controls oil mining licenses OML 71 and 72, valued at $497 million, as well as private holdings that include a $76 million jet fleet, $148 million in Lagos real estate, $100 million in Lekki Free Trade Zone land, and about $744 million in cash.