Key points

-

Abdul Samad Rabiu net worth drops $400 million.

-

BUA Cement reports strong profit growth in H1 2025.

-

Rabiu slips in global billionaire ranking but stays No. 2 in Nigeria.

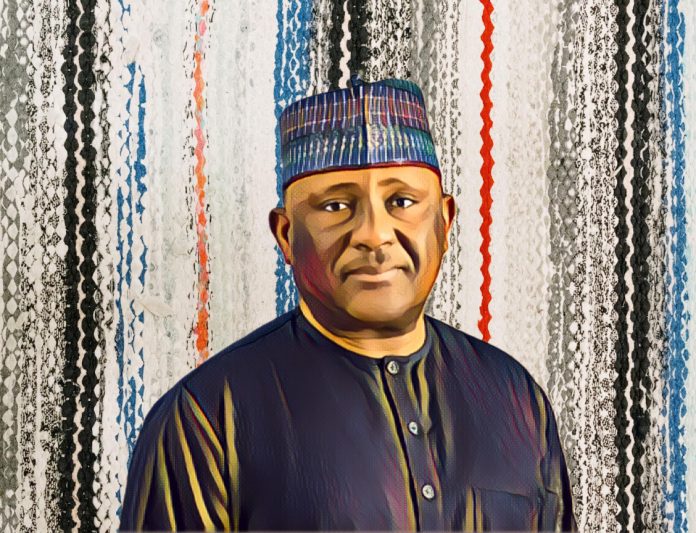

Nigerian billionaire Abdul Samad Rabiu has seen his net worth decline by $400 million in less than a month after shares of BUA Cement, his publicly listed company, retreated sharply on the Nigerian Exchange.

Forbes had valued Rabiu’s fortune at $7.6 billion earlier this month. That figure now stands at $7.2 billion, following a 17 percent fall in the value of BUA Cement stock over the past 21 days.

Rabiu holds a controlling 97.66 percent stake in the company, Nigeria’s second-largest cement producer.

BUA Cement H1 earnings show strong growth

Despite the decline in its share price, BUA Cement posted strong financial results for the first half of 2025.

The company reported revenue of N580.3 billion ($380 million), compared with N363.94 billion ($237.7 million) during the same period in 2024.

Net income jumped more than fivefold, climbing from N34.25 billion ($22.4 million) in the first half of 2024 to N180.89 billion ($118.1 million) this year.

According to a report by Billionaires.Africa, earnings per share increased to N5.34 ($0.035), reflecting improved efficiency and strong market demand for cement.

The company, with an annual production capacity of 11 million tons, benefited from robust demand driven by Nigeria’s expanding real estate sector and large-scale infrastructure projects.

Rabiu’s global ranking slips but local standing holds

The drop in Rabiu’s fortune has pushed him down to 512th place on Forbes’ global billionaire list.

In Nigeria, however, he remains the second-richest individual, behind Aliko Dangote, whose wealth is estimated at $24.4 billion.

Market analysts say the pullback in BUA Cement shares reflects investor profit-taking after the stock hit its highest levels since February 2024.

While the company’s earnings remain solid, sentiment on the Nigerian Exchange has shifted as investors adopt a more cautious stance.

Rabiu, who founded BUA Group with interests spanning cement, sugar, and real estate, continues to wield significant influence in Nigeria’s industrial sector.