KEY POINTS

- Custodian shares make Oshin’s net worth $43 million.

- The stock goes up 142 percent, which is more than the market as a whole.

- Custodian points out how strong Nigeria’s insurance industry is.

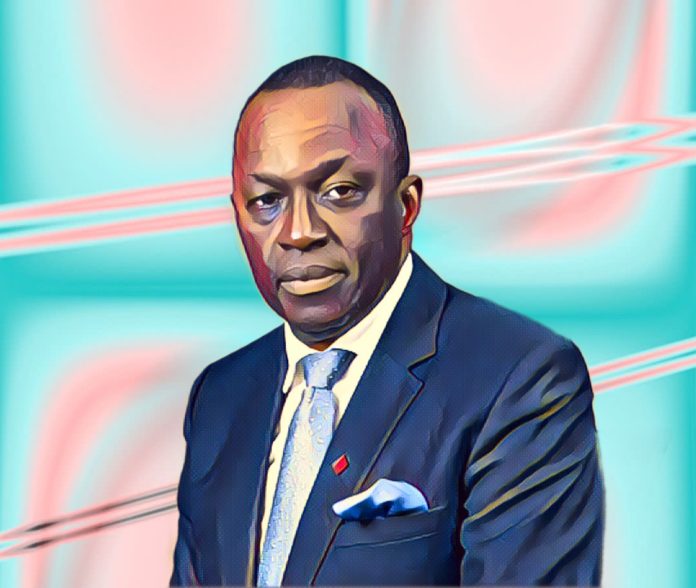

Wole Oshin, a Nigerian insurance mogul, has seen the value of his shares in Custodian Investment Plc rise to about $43 million after a big jump in the company’s stock this year.

Oshin, the group’s managing director and biggest shareholder, owns 27.39 percent of Custodian, which has more than 1.61 billion shares listed on the Nigerian Exchange. That shareholding has grown by N38.58 billion ($25.25 million) in just five months, making its total value N65.65 billion ($42.96 million).

Oshin’s gains come from the custodian stock surge

Oshin has led Custodian Investment since it was founded in 1991. It has since developed into a conglomerate of financial services companies with holdings in insurance, pensions, and real estate. The company’s stock has gone up 142.6 percent since April, from N16.8 to N40.75, giving it a market value of more than $157 million.

Doing better than the Nigerian market

Custodian has done better than many of its counterparts on the NGX, with a return of 138.3 percent thus far this year. A $100,000 investment in January would now be worth around $238,300. This shows investors remain interested in the company despite the uncertain economy.

Custodian points out how strong the insurance industry is

Billionaire Africa says the recovery shows that investors are once again confident in Nigeria’s insurance and financial services business, which is often overshadowed by banking and oil. Custodian’s performance makes it one of the best Nigerian stocks of 2025 and cements Oshin’s place as a prominent player in the country’s financial markets.