KEY POINTS

- TY Danjuma family office trims loss for 2024.

- Assets remain stable at about $114 million.

- Conservative investment approach shields against volatility.

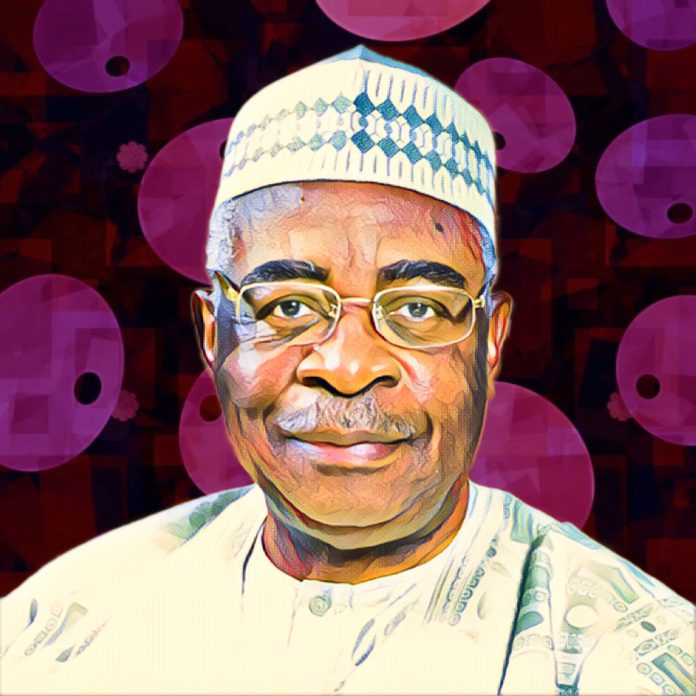

The family office of Nigerian billionaire Theophilus “TY” Danjuma reported a smaller deficit for the year ending June 30, 2024, helped by investment gains that offset declines in property values and rising borrowing costs.

The UK-based TY Danjuma Family Office Ltd. posted a total comprehensive loss of £1.85 million ($2.47 million), improving from a £4.44 million ($5.95 million) loss in the prior year, according to filings with the Companies House. A £1.68 million ($2.25 million) net gain on financial assets softened the impact of a £1.02 million ($1.36 million) markdown on investment property and higher interest expenses.

Balance sheet steady, liquidity intact

Despite a tough year, total assets stood at £85.3 million ($114.3 million), only slightly below last year’s level. Net equity slipped to £63.97 million ($85.72 million) from £65.84 million ($88.23 million). Management said the group remains fully funded with enough liquidity to sustain operations.

The office’s portfolio leans on hard assets and listed securities. Investment properties were valued at £39.06 million ($52.33 million), while investments at fair value reached £34.16 million ($45.77 million). Cash holdings came in at £4.05 million ($5.43 million).

TY Danjuma family office keeps conservative play

The entity earns income from advisory services across the Danjuma business network. In 2024, it generated £604,000 ($809,000) for advising the TY Global Fund and additional fees from SAPETRO, TY Holdings, and the NAL-Comet Group.

Costs and financing costs stayed high, which led to a pre-tax loss of £1.30 million ($1.74 million). However, the reduced loss showed how Danjuma was careful with his money.

A window into Danjuma’s larger empire

The UK office represents a slice of the billionaire’s holdings, distinct from his industrial ventures such as South Atlantic Petroleum (SAPETRO). Danjuma’s broader interests span oil, fertiliser, shipping, property, and hospitality including investments in Notore Chemical Industries, Japaul Gold & Ventures, and Nile Exploration and Development.

According to Billionaires Africa, his foundation, the TY Danjuma Foundation, channels his philanthropic work into healthcare and education across Nigeria.

A concentration on being strong in the face of uncertainty

The most recent data demonstrates that Danjuma has been able to keep his fortune safe even when the global economy is unstable. The TY Danjuma family office still had a robust balance sheet and cash flow, even though they lost less money. This is a sign of the billionaire’s careful investment style, which he has used to protect his money well into his ninth decade.