KEY POINTS

- Reps decry “arbitrary and excessive” bank deductions.

- CBN urged to publish approved list of bank charges.

- Committee to summon banks and monitor compliance.

The House of Representatives has ordered an investigation into what it described as “arbitrary, excessive, and unexplained” deductions from customers’ accounts by commercial banks across Nigeria.

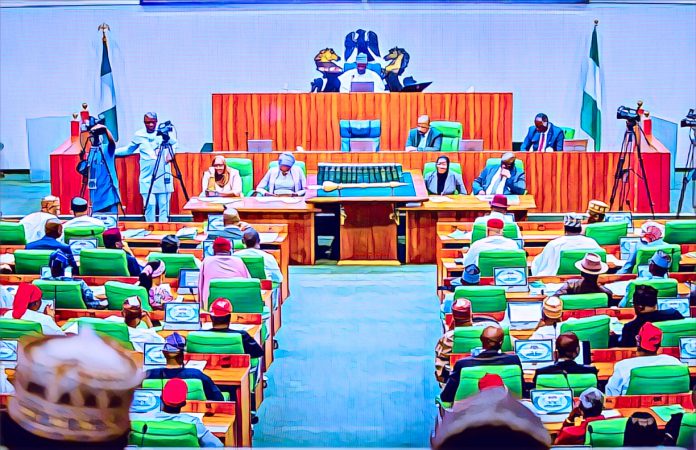

The resolution followed a motion of urgent public importance moved by Tolani Shagaya, a lawmaker from Kwara State, during Tuesday’s plenary session presided over by Speaker Tajudeen Abbas.

Titled “Need to curb arbitrary bank charges and protect Nigerian customers,” the motion decried the growing wave of hidden and unjustified fees levied on bank customers despite repeated cautions from the Central Bank of Nigeria (CBN).

Lawmakers revisit lingering complaints

Shagaya reminded the House that similar issues had surfaced in 2016 and 2023 when lawmakers raised concerns about shady bank deductions, including abuses of the N65 ATM withdrawal fee and unauthorised account maintenance charges.

Past motions, he said, had revealed patterns of “fleecing” customers through illegal deductions in violation of financial laws.

“These incessant charges have become not only a source of frustration but also a barrier to financial inclusion,” Shagaya said. “When citizens lose confidence in the banking system, it defeats the government’s efforts to build a robust digital and cashless economy.”

He listed recurring complaints such as excessive SMS alert fees, card maintenance costs, account maintenance deductions, and high interbank transfer fees.

CBN, banks to face tough questions

Following the debate, the House directed the CBN to publish a simplified and transparent list of all approved bank charges to help consumers understand and monitor deductions.

It also urged the apex bank to strictly enforce compliance among deposit money banks and sanction violators.

Lawmakers further mandated the CBN to set up a responsive redress mechanism for customers seeking refunds or explanations for illegal charges.

In addition, the Federal Competition and Consumer Protection Commission (FCCPC) was asked to launch a nationwide campaign educating bank users about their rights and complaint channels.

The House Committee on Banking Regulations has ordered representatives of the CBN and major commercial banks to appear before it to address the issue and propose stronger consumer protection measures.