KEY POINTS

-

BUA Cement profit rose to $200 million in 2025.

-

Revenue climbed to N858.7 billion amid higher prices.

-

The company strengthened its assets and retained earnings.

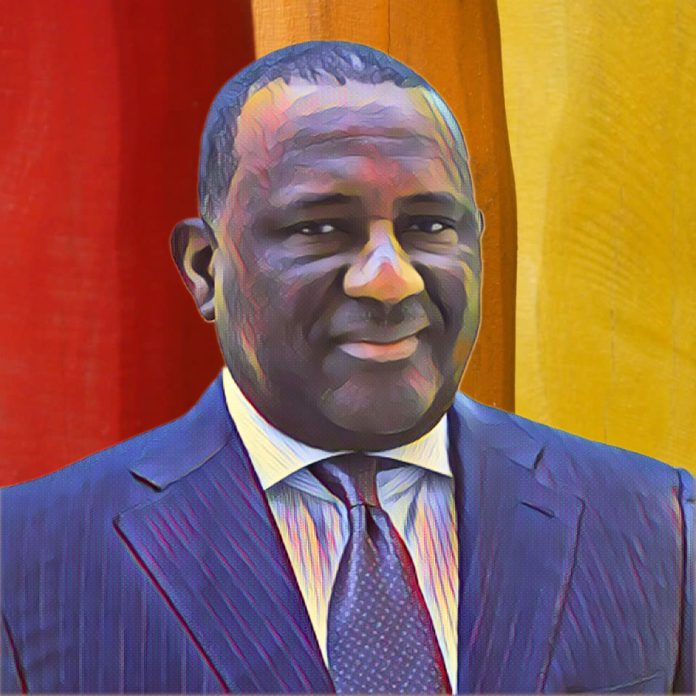

BUA Cement Plc, led by Nigerian billionaire Abdul Samad Rabiu, delivered a strong performance for the nine months ending September 30, 2025, with profit climbing to $200 million.

The result marks one of the best financial outcomes in the company’s history, supported by higher sales and disciplined cost management.

BUA Cement posts record profit growth

The company’s unaudited financial statements show profit rising sharply from N48.97 billion ($33.6 million) in the same period of 2024 to N289.86 billion ($200 million) this year. For comparison, BUA Cement recorded N73.9 billion ($50.7 million) in full-year profit in 2024, underlining the scale of its current earnings momentum.

Revenue growth played a key role in the performance. Rising cement prices and sustained market demand lifted the company’s top line to N858.7 billion ($590 million) for the nine-month period, up from N583.4 billion ($400.7 million) in 2024. The result demonstrates the company’s ability to manage volume fluctuations while maintaining profitability.

Nigeria’s second-largest cement maker expands reach

BUA Cement, a key subsidiary of the BUA Group, has grown into a central player in West Africa’s construction market. With an installed production capacity of 11 million tonnes per year, it remains Nigeria’s second-largest cement manufacturer after Dangote Cement. The company continues to play a significant role in supplying materials for infrastructure, housing, and commercial projects across the region.

Rabiu, who founded the company and retains a 97.66 percent ownership stake, has expanded BUA Cement into one of Nigeria’s most profitable industrial entities. His business strategy, focused on efficiency and long-term value creation, has helped secure steady returns even in a challenging economic environment. Forbes places his net worth at around $8.7 billion.

Retained earnings and assets show strong growth

The company’s balance sheet also strengthened. Retained earnings more than doubled from N175.7 billion ($120 million) as of December 31, 2024, to N396.1 billion ($272.2 million) by September 30, 2025. Total equity rose from N388.55 billion ($266.5 million) to N608.9 billion ($418.2 million), while total assets increased from N1.57 trillion ($1.078 billion) to N1.61 trillion ($1.1 billion), according to Billionaire Africa.

With strong demand, solid asset growth, and an expanding footprint, BUA Cement remains well-positioned to sustain its role in Nigeria’s construction sector and maintain its record of profitability into the coming quarters.