Key Points

-

Fuel surcharge delayed until naira strengthens or oil prices fall.

-

Committee rejects FERMA’s push for early implementation.

-

Tax reforms aim to ease burden on haulage and logistics sector.

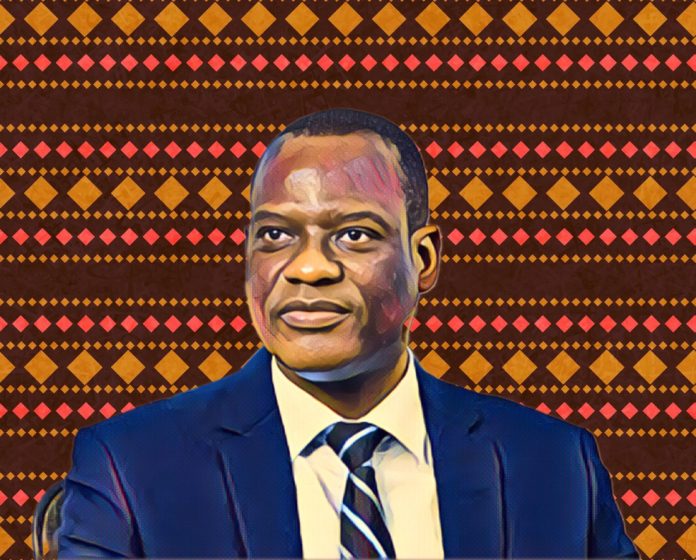

Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, says the proposed 5 percent fuel surcharge will not take effect until the naira appreciates or global oil prices fall.

He spoke at the Haulage and Logistics Magazine Conference and Exhibition in Lagos on Tuesday. Oyedele said the committee decided to delay the plan to avoid adding pressure on Nigerians.

Timing tied to economic recovery

“The surcharge is a good idea, but this is not the right time,” he said. “We’ll wait until the economy improves.

When the naira gains strength or crude prices drop, the surcharge won’t increase fuel costs.”

He explained that the surcharge was first introduced under former President Olusegun Obasanjo.

The policy dedicates part of fuel revenue to road maintenance — 40 percent for federal roads and 60 percent for state and local government projects.

“The idea works in more than 150 countries,” he said. “But most of Nigeria’s 200,000 kilometers of roads are still in poor shape, so we must apply the policy carefully.”

Committee rejects early collection

Oyedele said the Federal Roads Maintenance Agency (FERMA) had asked to start collecting the levy soon after the fuel subsidy was removed. The committee refused.

“We said no. Starting now would be insensitive,” he said. “The draft tax law includes the surcharge, but it will only take effect after the finance minister gives official approval. That’s a built-in safeguard.”

Reforms to cut transport costs

He said ongoing tax reforms would help the haulage and logistics industry by removing duplicate taxes and reducing costs.

“We’re not introducing new taxes,” Oyedele said. “We’re scrapping unnecessary ones that frustrate transporters and raise prices.”

He added that small logistics companies with annual turnover below N100 million would be exempt from company income tax.

Eligible operators would also get VAT refunds and other incentives to support compliance and cut expenses.

Oyedele said the reforms aim to simplify Nigeria’s complex tax system and make revenue sharing more transparent across all levels of government.

“Our focus is a simple and fair system that supports growth,” he said.