KEY POINTS

- Tiger Brands exits Cameroon market with $76 million sale.

- Simplification aligns with strategy to focus on domestic growth.

- Sale backed by syndicated loan from BGFIBank Group.

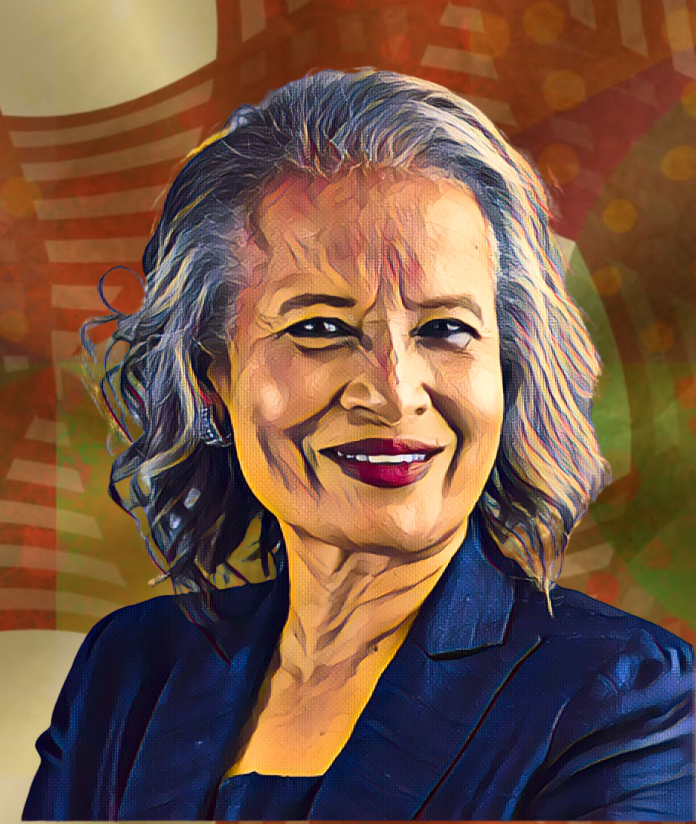

Tiger Brands, the Durban-based consumer goods company chaired by Geraldine Fraser-Moleketi, is set to exit the Cameroon market. The company reached an agreement to sell its 74.69 percent stake in Chocolaterie Confiserie Camerounaise to Minkama Capital Limited for $76 million.

The transaction still requires regulatory approval. Sources familiar with the deal said it is supported by a syndicated loan arranged by BGFIBank Group, matching the purchase price. Investors continue to show interest in African consumer goods businesses offering steady returns.

Tiger Brands Cameroon exit reflects portfolio simplification

The sale is part of Tiger Brands’ broader effort to streamline its international operations. Executives have spent years reassessing non-core markets outside South Africa. Observers note that analysts will closely watch the new owners’ financial health, given the loan’s pressure on Chococam during its early years under new management.

With a market capitalization of $3.4 billion on the Johannesburg Stock Exchange, Tiger Brands remains one of the continent’s largest listed food producers. The company has been working to stabilize its operations and recover shareholder trust since Fraser-Moleketi became chair in 2020. Shares of the company have gone up more than 15 percent this year, which shows that investors are becoming more confident.

Tiger Brands refocuses on domestic growth and profitability

According to Billionaires Africa, this is the next step in the company’s restructuring efforts, which included selling its canned fruit unit, Langeberg and Ashton Foods, for a symbolic one rand. Tiger Brands retained a contract manufacturing agreement to supply canned fruit for its KOO label.

Earlier this year, the company also sold its 24.38 percent stake in Chilean consumer goods firm Empresas Carozzi S.A. for $240 million through its subsidiary Inversiones Tiger Brands South America. These moves show that the company’s plan is to get rid of non-core international assets and focus on growing successful domestic operations.

Tiger Brands’ withdrawal from Cameroon is part of its shift toward concentrated, long-term growth while keeping investor confidence in its primary countries.