KEY POINTS

- SEC enforcement in 2026 will depend on authorities given by ISA 2025.

- The regulator plans to take stronger action against market misuse.

- The goal of digital changes is to make things clearer and more efficient.

The Investments and Securities Act, which was just passed, gives Nigeria’s Securities and Exchange Commission more power to crack down on misuse and restore investor trust. In 2026, they plan to step up market policing by a lot.

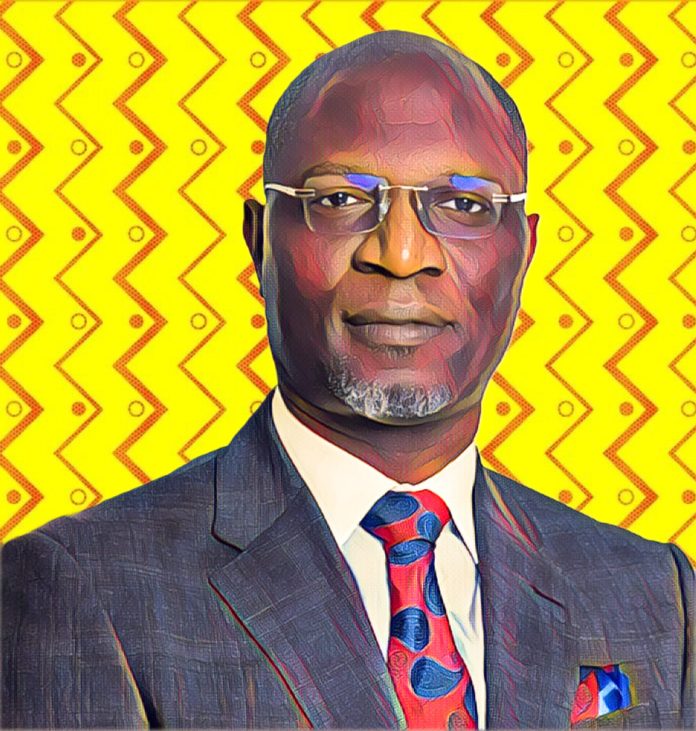

The push, outlined by SEC Director-General Emomotimi Agama, follows the passage of the Investments and Securities Act 2025, which strengthens the regulator’s authority over supervision, investigations and enforcement across the capital market. Officials say the framework positions the watchdog to act faster and more consistently against misconduct.

Agama said the Commission will deploy its enhanced mandate to address insider dealing, fraudulent investment schemes and other violations that erode trust in Africa’s largest economy. Enforcement actions, he added, will be carried out in line with due process, with predictability and consistency central to rebuilding credibility among domestic and foreign investors.

SEC enforcement 2026 gains legal backing

Furthermore, Agama said the new law grants the SEC wider powers to intervene in market abuse cases and impose sanctions when participants breach the rules, stressing that the Commission will exercise those powers firmly and impartially. He warned that authorities cannot treat criminal conduct as a private dispute if they want to protect market integrity.

Agama described the enforcement push as part of a broader effort to strengthen the resilience and efficiency of Nigeria’s capital market, arguing that confidence depends on clear rules applied evenly. Market discipline, he further said, is essential as Nigeria seeks to channel long-term savings into productive investment.

SEC enforcement 2026 expands digital oversight

Alongside tougher enforcement, the SEC plans to accelerate digitalisation of its regulatory processes. While he added that streamlined approvals, automated filings, and improved disclosure systems will cut delays, boost responsiveness, and improve transparency.

The Commission also plans to roll out enhanced disclosure standards, including environmental, social and governance reporting, and conduct a structured recapitalisation and governance review of market intermediaries to ensure financial resilience and sound risk management.

Investor protection remains a priority, particularly for retail investors and small and medium-sized enterprises. He added that authorities must balance broader market access with safeguards that limit fraudulent schemes.

Looking ahead, the SEC chief said regulation would support, rather than hinder, Nigeria’s economic transition. Regulators will launch a nationwide financial literacy programme in 2026 to boost investor awareness and reduce exposure to scams.