KEY POINTS

- Indimi earned $22 million from Jaiz Bank shares.

- Jaiz Bank shares surged on the Nigerian Exchange.

- Jaiz Bank gains benefited from a stronger naira.

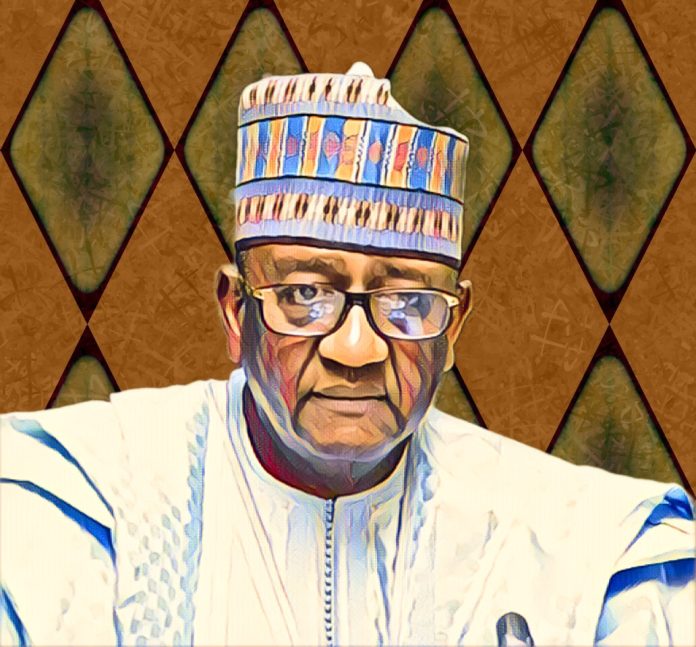

Because Jaiz Bank Plc’s shares went up a lot, Nigerian oil tycoon Mohammed Indimi made roughly $22 million more in 2025. This means that investors trust the stocks of Nigerian banks again since the currency is more stable.

Indimi, the chairman of Oriental Energy Resources and the person who founded it, holds the most shares in Jaiz Bank. He controls 29.36 percent of the bank, which is worth roughly 13.09 billion shares. Market data shows that the value of such position went up by about N29.6 billion over the course of the year. This is equal to $22.7 million.

Investors went back to local stocks because banks were making a lot of money and the naira was gaining stronger against the U.S. dollar. This made returns even greater for international and dollar-based investors.

Indimi’s wealth grows when Jaiz Bank makes money

Jaiz Bank shares did very well on the Nigerian Exchange in 2025. The stock price went climbed 75.33 percent in naira, from N3 at the start of the year to roughly N5.26 by the end of the year.

Billionaire Africa says changes in currencies made the gain much greater. Jaiz Bank’s stock price went up 89.46 percent in dollars as the naira soared, which made Indimi’s big assets worth more. His stock was valued about N39 billion, or $25.4 million, at the start of the year. It had increased to more over N68.9 billion, or $48.2 million, by the end of 2025.

Even if investors are still anxious about inflation and policy issues, the rising stock prices and currency support signal that Nigeria’s stock market might make a lot of money when the economy settles down.

The growth in Jaiz Bank’s stock price backs up the rise in shares

Jaiz Bank is Nigeria’s biggest non-interest lender and the first Islamic bank in the country. It began in 2003. It started doing business in 2012 and received a national banking license in 2016. This enabled it grow beyond its original location. It is in Abuja.

The bank has since opened more branches and invested in digital banking services for individuals, corporations, and the government. It has created a loyal customer base by not charging interest, which is unlike how most banks lend money.

People who put money into the stock market saw how well it did. If you had acquired $100,000 worth of Jaiz Bank shares at the beginning of 2025, they would be worth around $189,460 now. The money is worth more now that the price has gone up. Indimi said that the rise showed how important it is to hold Nigerian bank equities for a long time when the market is doing well.