Key points

-

The Mecure Industries stock rally has added billions of naira to Udani family holdings.

-

Thin free float has amplified gains during the Mecure Industries stock rally.

-

Local pharmaceutical manufacturing demand supports recent price momentum.

Mecure Industries Plc has staged one of the Nigerian Exchange’s steepest recent advances, adding roughly 239 percent in less than three months and dramatically increasing the paper wealth of its two largest shareholders, Samir Udani and Arjun Udani.

The pharmaceutical manufacturer traded at 30.70 naira on Nov. 3, 2025. By this week, the stock had climbed to 104 naira, extending gains to 238.76 percent over the period. At that price, the combined holdings of the Udani family stand at about 266.68 billion naira, or $186.49 million, based on an exchange rate of 1,430 naira to the dollar.

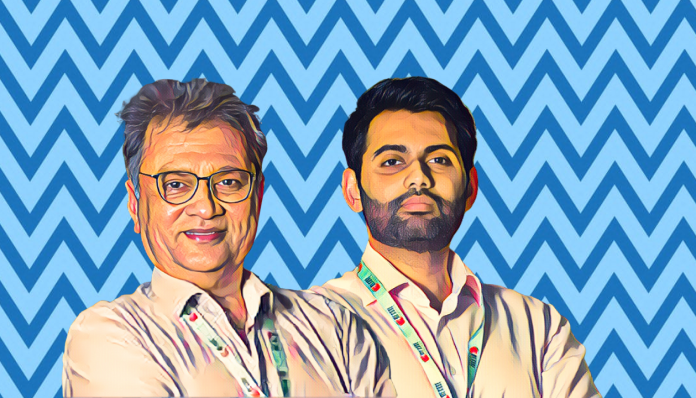

Samir Udani, the company’s founder and chairman, owns 1,291,779,280 shares valued at roughly 134.35 billion naira. His son, Arjun Udani, who serves as co–chief executive officer overseeing finance and supply chain operations, holds 1,272,459,257 shares worth about 132.34 billion naira.

Mecure Industries stock rally reshapes ownership wealth

The run has transformed Mecure from a little-followed listing into a market standout. The company carries a market capitalization of about 416 billion naira ($290 million) and operates manufacturing facilities that produce medicines, nutraceuticals and consumer health products in tablets, capsules and syrups.

Analysts say the rally reflects investor appetite for locally produced pharmaceuticals as currency weakness and rising import costs make foreign-sourced drugs less attractive. Mecure sells its products all around the country through pharmacies and other stores. This is becoming more important as lawmakers push for more manufacturing in the US.

The stock’s path seems even more impressive when you look at its history of listings. Mecure joined the Nigerian Exchange in November 2023 through a listing by introduction. This meant that existing shares were sold without generating new money. The admission price was 2.96 naira, which means that the current share price is more than 34 times what it was at first.

Structure questions follow Mecure Industries stock rally

Billionaires Africa reports that the rise in Lagos trading rooms has sparked a new discussion about how the market works. Mecure is still closely held, and there aren’t many shares available for daily trading. This can make prices swing more when demand goes up.

Traders say that these kinds of situations frequently make it hard to tell the difference between moves based on fundamentals and moves based on flow. While Mecure’s operating story has improved, the small free float means marginal buying interest can push prices sharply higher, and reversals can arrive just as quickly.

The Udani family’s control underscores that dynamic. Samir created the company when it was founded in 2005 and is still in charge of its strategy as chairman. Arjun is in charge of important financial and logistical tasks. They are both at the core of a rally that has become a case study in how ownership structure can affect market results.