KEY POINTS

- The Coleman commercial paper deal is valued 50 billion Naira.

- Money will aid with growth and working capital.

- The growth plan is based on making fiber optics.

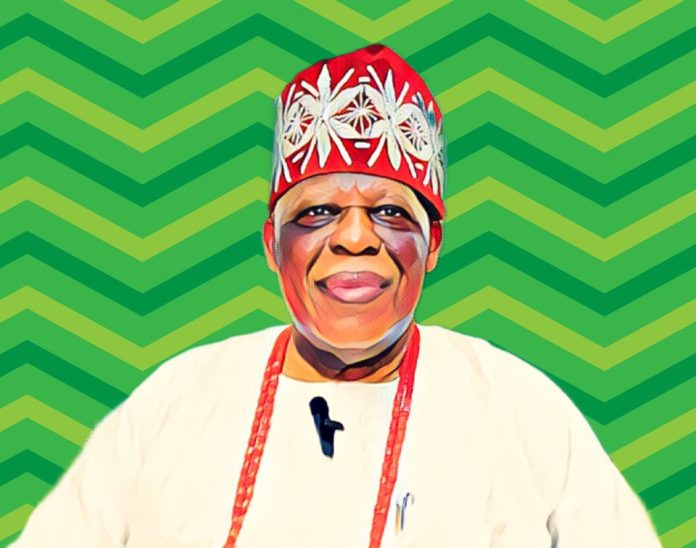

Nigerian businessman Solomon Kayode Onafowokan is going back to the debt market because Coleman Technical Industries is offering up to N50 billion ($37.0 million) in commercial paper to help with operations and growth.

Coleman’s commercial paper program has a maximum amount of N100 billion ($74.1 million), and this issuance is part of that program. Afrinvest made the offer, which includes Series 5 and Series 6 notes that will mature in 182 days and 270 days. The idea is to get investors who want to run a manufacturing business in the United States for a short time.

You can invest as little as N5 million ($3,704), and you can add more in N1,000 increments. The company will use the money for working capital to cover raw materials, inventory, and other needs that arise as it expands production capacity.

The Coleman Commercial Paper Program is Getting Bigger

Coleman makes wires and cables for buildings, housing developments, industrial facilities, and infrastructure that needs power. Since 1975, the company has been in business. The business sells cable to contractors, utilities, and manufacturers, so it’s a local choice instead of imported cable.

Even though it was more advantageous to trade in imports, Onafowokan has been pouring money into plant capacity. Coleman is now a well-known name in Nigeria’s corporate sector because of this.

Nigerian firms often use commercial paper to raise money because it gives them additional options when borrowing costs are high. Shorter-term notes allow businesses to get money and refinance when they need to, but industrial businesses that deal with changing input prices need to be very careful about how they handle their cash flow.

Fiber optics support plans for growth

The Coleman commercial paper surge happens because the corporation is making more things, mainly fiber optics. It just built a factory in Sagamu, Ogun State, that creates fiber optic cables. The company can create over nine million kilometers of cables every year. The purpose is to help Nigeria’s broadband growth and exports to other countries.

Coleman has also invested in upstream processes, such as a continuous casting smelting plant in Sagamu for aluminum and copper. The goal of the plan is to reduce the need for imported commodities and make the economy less vulnerable to changes in currency value. Billionaires Africa says that the company has talked about how it is involved in significant infrastructure projects like Nigeria LNG’s Train 7.

The most recent round of finance gives Coleman more freedom to keep creating items, stock up on supplies, and compete in sectors connected to electrical and connectivity infrastructure.