KEY POINTS

- Dossou-Aworet lifts Aradel stake to 13.77 perfect.

- Nigerian oil portfolio now worth nearly $500 million.

- Veteran investor key in Shell’s $2.4 billion exit.

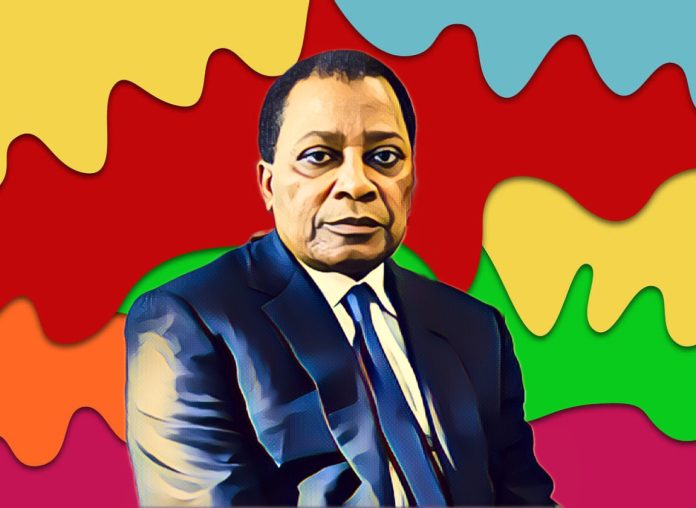

Gabonese oil magnate Samuel Dossou-Aworet has tightened his grip on Nigeria’s energy market with a fresh $64.4 million investment in Aradel Holdings, lifting his stake in the oil and gas firm to 13.77 percent.

The Petrolin Group founder, a fixture in African petroleum circles for three decades, is now Aradel’s largest individual shareholder, underscoring his long-term bet on Nigeria’s oil sector even as global majors scale back.

Oil tycoon lifts Aradel stake to 13.77 percent

Regulatory filings on the Nigerian Exchange show Dossou-Aworet bought 173.79 million shares on Sept. 25 through Petrolin Ocean Ltd. at an average N555 each. Furthermore, the deal increased his position from 8.31 percent at the end of June, with his holding now worth nearly $200 million.

Portfolio tops $500 million across NGX stocks

The investment further adds to his $291 million stake in Seplat Energy, bringing his Nigerian portfolio close to half a billion dollars. Samuel Dossou-Aworet also holds 16.8 percent of London-listed Tullow Oil, further cementing his reputation as one of Africa’s most influential energy investors.

Veteran dealmaker steers landmark transactions

Since founding Petrolin in 1992, Dossou-Aworet has played a central role in reshaping Africa’s oil landscape. His ventures include the 2012 purchase of a 45 percent interest in OML 34 from Shell, Total and Eni, also more recently, joining Waltersmith, ND Western, First E&P and Aradel in the Renaissance consortium.

According to Billionaires Africa, the group sealed a $2.4 billion acquisition of Shell’s onshore oil business in Nigeria earlier this year, marking one of the country’s biggest energy transactions.