Nigerian banks have witnessed a surge in customer deposits this year, as the Central Bank of Nigeria (CBN) has increased lending to the private sector and the government, and the devaluation of the naira has raised the value of dollar accounts. According to data compiled by BusinessDay from the financial statements of the five biggest banks, their combined deposits grew by N15.7 trillion in the first nine months of this year to N53.34 trillion, compared to an increase of N4.47 trillion in the same period of 2022.

The growth in bank deposits reflects the expansion of the money supply in the economy, which hit a record high of N67.28 trillion in September, up from N52.16 trillion at the end of last year, according to the CBN. The increase in money supply has been attributed to several factors, such as the federal government’s borrowing from the CBN, the push for financial inclusion, as well as the boost in the naira equivalent of the dollars in domiciliary accounts and increased federal allocations to states following the devaluation of the naira.

Adeola Adenikinju, a professor of economics and president of the Nigerian Economic Society, said the recent devaluation has boosted the naira value of deposits in domiciliary accounts, constituting more than a third of deposits in the banking sector. He said that the naira had moved from about 460 to a dollar before June, when the CBN tried to do a convergence, to about 800/$ at the I&E window. “That has almost doubled the value of the domiciliary accounts in naira terms. I think that is the major factor driving the deposit growth,” he said.

He also said that the federal government’s borrowing from the CBN could be responsible for the deposit growth because “every spending will affect both savings and consumption”. CBN data show that in the first half of this year, the federal government borrowed N2.99 trillion from the Ways and Means Advances, a loan facility used by the apex bank to finance the government during temporary budget shortfalls subject to law-imposed limits.

Johnson Chukwu, managing director of Cowry Asset Management Limited, said the CBN’s loans have pushed up the money supply in the country, adding that the increase in customer deposits has helped boost banks’ profitability. “Inflationary pressures will go up because money supply has increased. When customer deposits increase, it means banks have more money to lend,” he said.

The country’s inflation surged to a fresh 18-year high of 26.72 per cent in September from 21.34 per cent at the end of 2022. Chukwu said that FAAC allocations to states and the federal government have increased significantly since June. That may also have generated a lot of economic activities related to government transactions, which may have been reflected in the movement of cash and deposits within the banking sector.

Muda Yusuf, chief executive officer of the Centre for the Promotion of Private Enterprise, said a likely uptick in economic activities post-election may have also boosted bank deposits. He said: “Before the election, there was a lot of anxiety and uncertainty. Confidence level in the economy is beginning to gather momentum. Inflation too could be a factor because you now need more money to do many transactions.”

He added that if deposits are increasing, it is good for the economy. “It’s good for financial inclusion – more people are entering the financial system. It is good for financial intermediation because the more money that goes through the system, the better.”

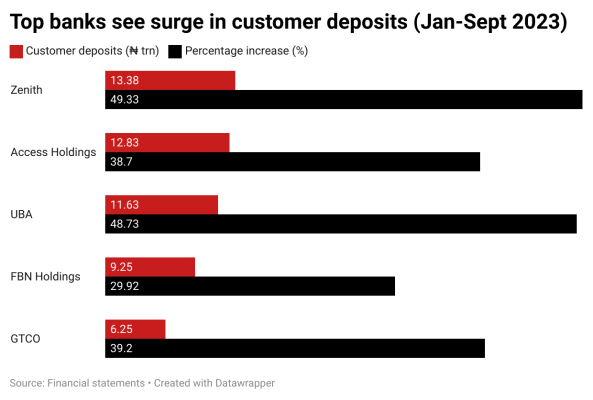

Zenith Bank Plc overtook Access Holdings as the biggest lender by customer deposits, with N13.38 trillion as of September. It recorded a 49.33 per cent growth against 24.27 per cent in the same period last year. United Bank for Africa Plc saw deposits jump 48.73 per cent to N11.63 trillion, compared to an increase of 10.36 per cent a year earlier. Customers of Guaranty Trust Holding Company Plc increased their deposits by 39.2 per cent to N6.25 trillion, compared to a growth of 6.23 per cent in the same period in 2022. Access Holdings Plc’s customer deposits rose by 38.7 per cent to N12.83 trillion as against an increase of 17.84 per cent last year, while FBN Holdings Plc saw a growth of 29.92 per cent to N9.25 trillion compared to 12.82 per cent a year earlier.

The growth in bank deposits is expected to support the economic recovery and development of the country and enhance the financial inclusion of the population.

Source: Business Day