KEY POINTS

- OpenAI could go public as early as 2026.

- The IPO may value the AI firm at up to $1 trillion.

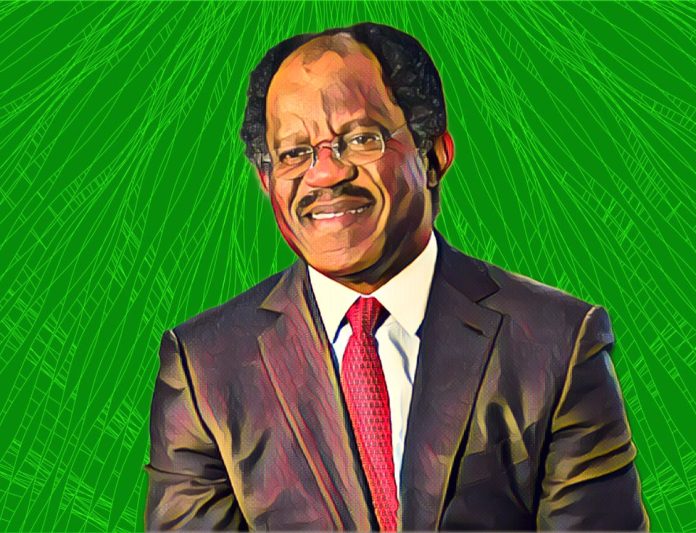

- Adebayo Ogunlesi’s board role aligns with rapid expansion.

OpenAI, the artificial intelligence company behind ChatGPT, is reportedly preparing for an initial public offering that could value the company at up to $1 trillion. This would make it one of the biggest IPOs in tech history.

According to Billionaires Africa, citing people familiar with the discussions, OpenAI has started exploring regulatory filings and could begin the process as early as the second half of 2026. The firm has considered raising about $60 billion during the offering, though timing and structure remain fluid.

Sources said Chief Financial Officer Sarah Friar has indicated a 2027 listing as a target date, though some advisers believe it could happen sooner, depending on market conditions and business performance.

OpenAI plans IPO to fund expansion

OpenAI projects an annualized revenue run-rate nearing $20 billion by the end of the year but continues to operate at a loss as it ramps up infrastructure and R&D spending.

The company was first established in 2015 as a nonprofit organization; however, in 2016, it underwent a transformation into a hybrid model that included a capped-profit subsidiary that was under the management of the nonprofit organization. This change is seen by many analysts as paving the road for a public offering.

Furthermore, going public would allow OpenAI to raise capital more efficiently, expand global operations, and use stock for acquisitions, reinforcing its position in the rapidly evolving AI ecosystem.

Ogunlesi’s OpenAI is behind the $11.9 billion expansion

Since Nigerian billionaire Adebayo Ogunlesi joined OpenAI’s board in January 2025, the company has ramped up its investment commitments and global partnerships.

It recently signed a $11.9 billion cloud computing deal with CoreWeave, formed new partnerships with data centers, and opened its first African artificial intelligence academy at the University of Lagos. These are all signs that it is more interested in emerging markets.

OpenAI raised $40 billion in funding earlier this year, bringing its value to $300 billion. The money will be used for research, infrastructure, and the development of AGI.

OpenAI buys Statsig for $1.1 billion

In September 2025, OpenAI revealed it will pay $1.1 billion in equity to buy Statsig, a company that does real-time analytics.

This will make ChatGPT more valuable for businesses and help OpenAI reach more individuals in a wide range of professions.

OpenAI’s major purpose is to create a network of tools, platforms, and processing power that makes OpenAI the hub of the AI revolution. Furthermore, this OpenAI $1 trillion IPO purchase is a step toward that goal.