KEY POINTS

- Aradel shares fell 5.24 percent in 40 days.

- Jadesimi’s stake lost about $5.9 million in value.

- The stock is still up double digits year-to-date.

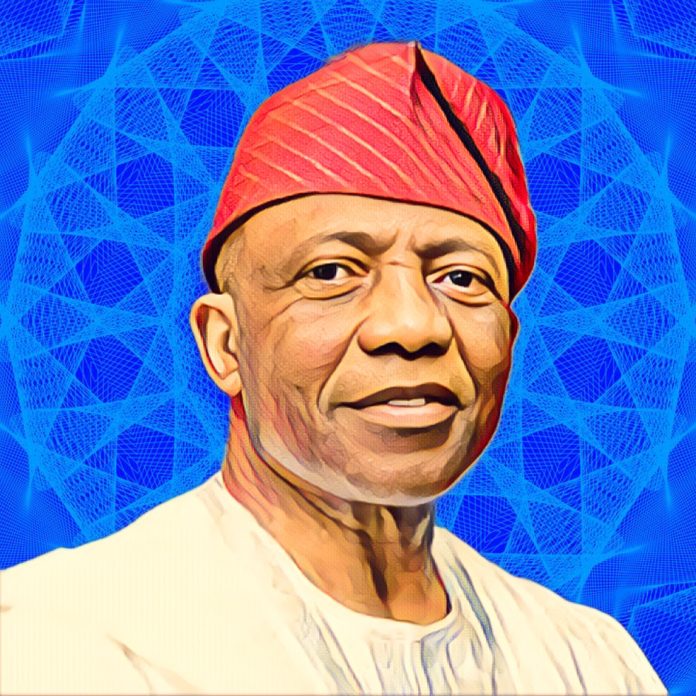

The value of Nigerian businessman Ladi Jadesimi’s interest in Aradel Holdings Plc has dropped by around $5.9 million since the company’s shares fell on the Nigerian Exchange (NGX).

The pullback comes after a strong rally earlier in the year and underscores how quickly investor sentiment can shift in Nigeria’s equity market, particularly for energy stocks exposed to oil-price movements, portfolio rebalancing and local liquidity conditions.

Jadesimi’s Aradel stake slips $5.91 million

Over the past 40 days, Jadesimi’s 5.27 percent stake in Aradel equivalent to 229,034,760 shares, declined by ₦8.61 billion ($5.91 million). The holding is now valued at about ₦155.72 billion ($106.86 million), down from ₦164.33 billion ($112.77 million), based on recent market data.

The decline has pared back gains recorded earlier in the year. Between Jan. 1 and Nov. 2, the value of Jadesimi’s stake rose by roughly $29.29 million, climbing from ₦136.96 billion ($95.19 million) to ₦179.11 billion ($124.48 million). During that period, Aradel ranked among the NGX’s top-performing stocks.

Aradel Holdings started off as Niger Delta Exploration & Production Plc in 1992. Now, it is one of Nigeria’s biggest indigenous energy businesses, having operations in upstream, midstream, and downstream sectors. It produces, processes, and distributes oil and gas as part of its business.

The company’s concentration on stable output and keeping costs under control has helped it deal with changes in policy and rising operational costs in Nigeria’s energy sector. This has kept investors interested even if things have been volatile lately.

Shares slide, market value dips below $2.1 billion

According to Billionaires Africa, Aradel holdings shares have declined 5.24 percent over the past 40 days, falling from ₦717.5 on Nov. 10 to about ₦679.9 at the time of writing. The drop has pushed the company’s market capitalization below $2.1 billion.

Despite the recent sell-off, the stock remains up about 13.7 percent in 2025, suggesting that while short-term price movements have reduced the paper value of Jadesimi’s holding, longer-term gains for the year remain intact.