KEY POINTS

- Order may redirect N14.57 trillion to Federation Account.

- Frontier and management fee deductions scrapped.

- Experts call for legal clarity under PIA framework.

The Federal Government’s new executive directive on oil and gas remittances could channel an estimated N14.57 trillion in additional revenues to the Federation Account, based on 2025 inflow data reviewed from the Federation Account Allocation Committee.

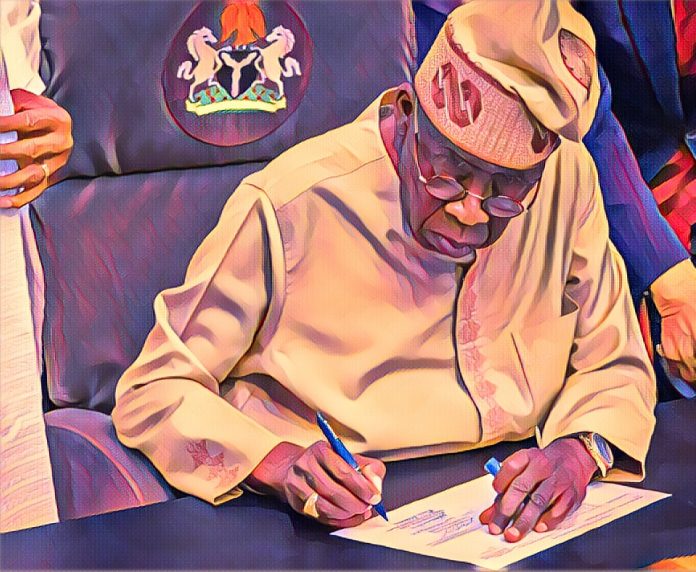

President Bola Tinubu’s order requires royalty oil, tax oil, profit oil, profit gas and other government interests under production sharing, profit sharing and risk service contracts to be paid directly into the Federation Account. The directive took effect Feb. 13, 2026.

An analysis of 2025 remittances suggests that the Nigerian National Petroleum Company Ltd. would forgo about N906.91 billion previously retained as management fees and allocations to the Frontier Exploration Fund. In addition, oil and gas royalties of N7.55 trillion and gas flaring penalties of N611.42 billion collected by the Nigerian Upstream Petroleum Regulatory Commission would be remitted directly.

The Nigeria Revenue Service’s collections of Petroleum Profits Tax and Hydrocarbon Tax totaling N4.905 trillion in 2025, along with N596.61 billion accrued by the Midstream and Downstream Gas Infrastructure Fund, bring the cumulative affected revenue streams to roughly N14.57 trillion.

PIA Deductions Curbed

Under the Petroleum Industry Act framework, NNPC retained 60 percent of proceeds from production sharing contracts split evenly between a 30 percent Frontier Exploration Fund and a 30% management fee. The executive order scrapped both deductions.

Monthly frontier allocations in 2025 fluctuated sharply, ranging from N6.83 billion in June to N82.61 billion in September, mirroring profit volatility. The same 30% rule applied to NNPC management fees.

The directive also requires operators to remit gas flare penalties directly to the Federation Account and subjects expenditures from the gas infrastructure fund to public procurement rules.

Fiscal Impact and Expert Views

President Tinubu also said excessive deductions and overlapping funds had weakened remittances, adding that oil and gas revenues must “serve the Nigerian people first.”

Professor Wumi Iledare of the Oil, Gas and Energy Policy Forum described the order as a significant fiscal intervention but cautioned that changes affecting statutory funds under the PIA may require legislative alignment to ensure legal certainty.

The Capital Market Academics of Nigeria endorsed the reform, calling it a corrective step toward fiscal transparency, while urging safeguards to protect institutional accountability.

If sustained, the reallocation could strengthen sub-national finances, reduce deficits and alter oversight structures across Nigeria’s oil and gas sector.