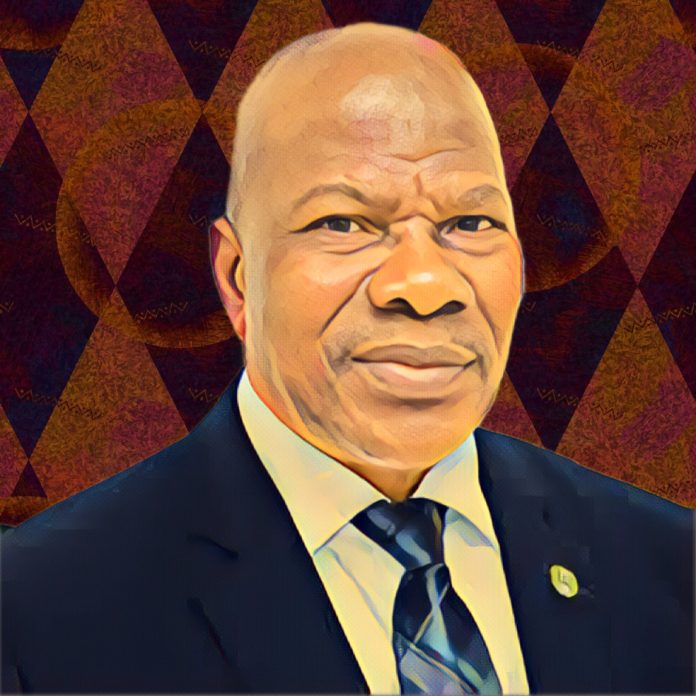

In a decisive move to reinforce accountability in Nigeria’s insurance sector, Mr. Sunday Thomas, the Chief Executive Officer of the National Insurance Commission (NAICOM), has placed a spotlight on insurance firms lagging in claims payment. Appointed by former President Muhammadu Buhari in 2020, Thomas brings over three decades of combined experience as both an operator and a regulator in the industry. His appointment as NAICOM CEO followed a notable tenure as the Director-General of the Nigerian Insurers Association in 2010 and his role as Deputy Commissioner in charge of technical matters from April 2017.

In a recent interview at a NAICOM-sponsored journalists’ conference in Uyo, Thomas addressed several critical issues facing the insurance industry, including the need for subscribers to revalue their assets in light of the current economic challenges, such as rising inflation and the foreign exchange crisis. He also announced the upcoming launch of a unified strategic master plan for the Nigerian insurance industry, set to be unveiled at the industry’s 2023 National Conference in October.

A key focus of Thomas’s regulatory strategy is the enforcement of prompt claim payments by insurance companies. NAICOM has taken a firm stance, directing all insurance companies to publish their outstanding claims to ensure transparency and accountability. Thomas warned of severe consequences for companies that fail to comply with this directive, including public naming and shaming. This move signifies NAICOM’s commitment to protecting policyholders and maintaining the integrity of the insurance sector.

The floating of the exchange rate has notably impacted the insurance industry, particularly concerning asset replacement. Thomas emphasized the importance of asset revaluation in response to inflation, stressing that life insurance is particularly vulnerable to these economic fluctuations. He urged the public to reassess the value of their assets to ensure adequate insurance coverage.

In addressing the publication of the status of insurance companies, Thomas explained the challenges involved. He highlighted the potential risks to a company’s recovery if its financial struggles were made public, drawing parallels with the regulatory practices in the banking sector.

The microinsurance business in Nigeria has seen growing interest, especially from low-income earners and informal sectors. Thomas noted an increase in patronage and applications for window operations from established insurance companies. However, he also acknowledged the challenges in network infrastructure, particularly in rural areas, due to security concerns. Despite these obstacles, NAICOM is committed to expanding insurance access, having licensed additional microinsurance companies and products, and established a dedicated unit to promote microinsurance and takaful institutions.

A significant legislative development during Thomas’s tenure is the consolidated insurance bill, which aims to address key issues in the industry, including recapitalization. Although it was not signed during the last administration, the bill is currently under review by the National Assembly. Thomas expressed optimism about its potential as a game changer for the sector.

Thomas also touched upon the issue of opaque operations in some insurance companies. Through NAICOM’s interventions, companies like IGI Insurance and IEI have attracted new investors and are undergoing restructuring. However, challenges remain, and the commission is working to resolve them while giving companies time to adjust their liquidity positions as per legal provisions.

The impact of the increase in motor insurance premiums, from N5,000 to N15,000, was also discussed. Despite the change being recent, Thomas noted the sector’s adaptation to the new pricing, which aims to offer greater benefits to policyholders.

In conclusion, under Mr. Sunday Thomas’s leadership, NAICOM is taking proactive measures to enhance the efficiency and reliability of Nigeria’s insurance sector. His efforts are focused on ensuring that insurance firms fulfill their obligations to policyholders, enhancing industry transparency, and adapting to the evolving economic landscape. These initiatives are set to solidify the insurance sector’s role in Nigeria’s broader financial ecosystem, providing a more secure and resilient framework for policyholders and stakeholders alike.