Nigeria’s Federal Inland Revenue Service (FIRS) has announced a new organizational structure and a strategic plan to increase its tax revenue collection by 57 percent to N19.4 trillion in 2024.

The FIRS, which is responsible for generating up to 70 percent of the government’s revenues, said the new structure and plan were aimed at enhancing its efficiency, effectiveness, and customer service.

The new structure, which will take effect from February 2024, will consolidate the core functions and support services of the FIRS under one umbrella, and tailor its services to specific taxpayer segments based on thresholds.

The new plan, which was unveiled at a two-day strategic management retreat in Abuja, will focus on driving voluntary compliance, leveraging technology, expanding the tax base, improving collaboration with stakeholders, and strengthening the capacity and welfare of staff.

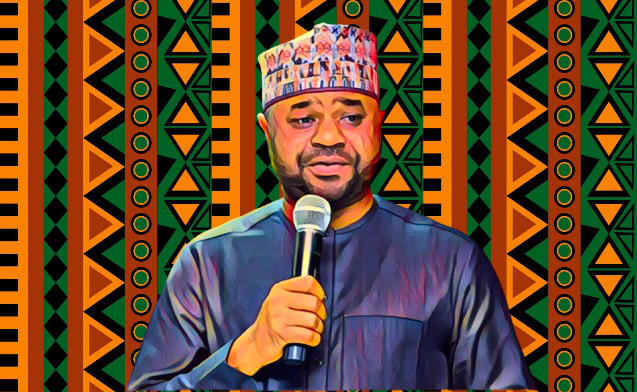

Zacch Adedeji, the executive chairman of the FIRS, said the new structure and plan were a critical milestone in revolutionizing tax administration in the country in a modernized and digitized manner.

He said the new era would be driven by a technology-based, customer-centric organizational structure designed to streamline processes and enhance efficiency in tax operations by ensuring that the evolving needs of taxpayers are met.

“The structure advocates for a comprehensive approach to taxpayer services, consolidating our core functions and support under one umbrella. By tailoring our services to specific taxpayer segments, we aim to simplify the taxpayer experience. No more complexities, no more overlaps—just a seamless and user-friendly interaction for every taxpayer,” he said.

He added that the new structure would also shift away from traditional tax categorization, and instead formulate taxpayer segments based on thresholds.

“This tailored approach ensures that taxpayers are guided and serviced according to their specific needs, eliminating confusion and redundancy in tax administration,” he said.

He assured that due process would be employed in the reformation and that the FIRS’s commitment to fostering a taxpayer-friendly environment that aligns with global best practices and positions Nigeria as a leader in contemporary tax administration.

He also reassured that taxes would not be raised, but that emphasis, as had been previously announced, would focus on “collecting better”, which the new structure and plan seek to achieve.

The FIRS’s new strategy comes at a time when Nigeria is facing fiscal challenges due to the impact of the COVID-19 pandemic, low oil prices, and rising debt levels.

The country’s tax-to-GDP ratio, which measures the efficiency and adequacy of the tax system, stood at 10.86 percent in 2021, compared to an estimated 6 percent previously reported, according to the National Bureau of Statistics.

This is still lower than the average of 15.6 percent for 33 African countries in 2021, and far below the government’s target of 18 percent in the next few years.

The FIRS said it recorded N12.37 trillion as taxes in 2021, indicating an over N2 trillion increase from the N10.17 trillion reported by the service the previous year.

The performance was pushed by non-oil collections, which went up 54 percent in 2021, higher than in 2020. While the oil sector generated N3.17 trillion, which is 25.6 percent, the non-oil sector contributed N9.2 trillion or about 74.4 percent.

Wale Edun, the minister of finance and coordinating minister for the economy, who spoke at the retreat, commended the FIRS for its improved revenue collections but urged a transparent process that earns the public trust and confidence to abide by tax rules voluntarily.

He reiterated that the emphasis of President Tinubu’s administration is to grow the economy, but they will not resort to borrowing given the elevated interest rates at the moment. They will rather drive internally generated revenue, domestic resource mobilization, and equity than debt.

He justified the recent move to tap the World Bank’s $1.5 billion loan, saying the financing is concessionary, cheap, and is particularly a seal of approval for the government’s policies, and will be deployed into specific projects in agriculture, education, and health.

He decried the country’s current tax-to-GDP ratio as inadequate and challenged the FIRS to raise it in line with the present tax policy. He, however, expressed optimism that the FIRS will surpass the target on the back of the current reforms and new collection strategies anticipated from the retreat.

Oluwatoyin Madein, the accountant-general of the federation, who also spoke at the event, said the FIRS has been a stronghold of government revenue generation.

She urged the effective implementation of tax laws and administrative processes that are all-inclusive and stakeholders-centric and not just taxpayers-centric and driven by accountability.

She said the tax process had been marred in the past by ineffective tax administration and that the tax office must continue to improve on the new direction it has adopted.

The FIRS said it hopes to leverage the new structure and plan to achieve its vision of becoming a world-class revenue administration, recognized for professionalism, integrity, and excellence.

Source: BusinessDay