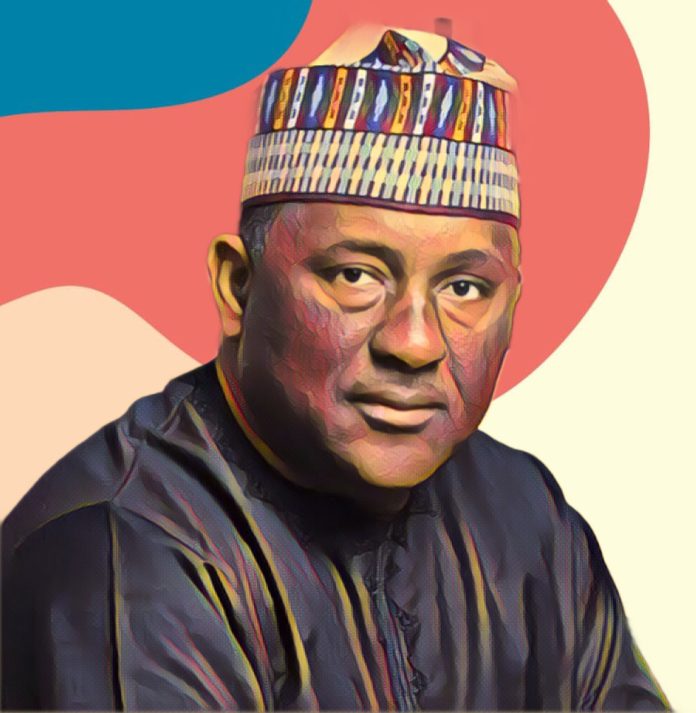

The Chairman of BUA Cement, AbdulSamad Rabiu, has revealed the reasons behind the rising cement prices in Nigeria, pointing fingers at cement dealers and economic challenges. Speaking at the company’s 8th Annual General Meeting in Abuja, Rabiu disclosed that his company’s attempt to stabilize cement prices at N3,500 per bag was thwarted by dealers. These dealers, instead of selling at the intended lower price, opted to make significant profits by selling a bag of cement at N7,000 to N8,000.

Rabiu explained that BUA Cement initially sold over a million tons to these dealers at the lower price, hoping the savings would reach consumers. However, the company quickly realized the dealers were exploiting the policy for their own gain. “We wanted that price to stay at that level, but dealers refused,” Rabiu said. “We did not want to subsidize dealers while they were making huge profits.”

In addition to dealer practices, Rabiu mentioned that economic factors such as the naira devaluation and the removal of fuel subsidies last year played significant roles in the decision to abandon the low-price policy. He noted that these economic shifts made it unsustainable for BUA Cement to continue with the N3,500 per bag pricing.

Impact of Economic Challenges on Cement Pricing

Rabiu highlighted how the broader economic environment impacted BUA Cement’s pricing strategy. The naira’s devaluation, which saw the exchange rate leap from about N600 to nearly N1,800 per US dollar, significantly affected the cost structure of cement production. “If you see the exchange rate then, and the exchange rate today, you will see that cement is actually cheaper today than what it was last year,” he argued, adding that if costs had risen proportionately with the exchange rate, cement could cost up to N10,000 per bag.

He further explained that energy costs, primarily denominated in dollars, were a significant factor. “Energy is the biggest cost, and our energy today is denominated in dollars. We buy gas to power our plants, and gas is priced in dollars,” Rabiu said. He revealed that one of BUA’s plants now faces a monthly energy bill of up to N16 billion, compared to N3 to N4 billion previously.

Financial Performance Amidst Rising Costs

Despite these challenges, BUA Cement has continued to perform strongly in the market. According to the company’s financial report, BUA recorded a 27.4% increase in revenue, rising to N460 billion from N361 billion in 2022. This growth was attributed to an increased market share despite the difficult economic conditions.

However, the company also faced rising production costs, with total costs increasing by 39.5% to N276 billion, up from N197.9 billion in 2022. The company reported a net foreign exchange loss of N70 billion, with N52.5 billion attributed to finance costs. Despite these setbacks, BUA Cement managed to report a net profit after tax of N69.5 billion and declared a N2 dividend per share.

Rabiu emphasized that BUA Cement is committed to ensuring that prices remain as stable as possible, despite the economic challenges. “We directly pushed to ensure that the price of cement is not getting higher than what it is today,” he stated, underlining the company’s effort to manage costs while facing an unpredictable economic landscape.

Source: Vanguard