The Federal Government announced its impending release of a detailed report, shedding light on the revenues generated in the six months following the fuel subsidy removal.

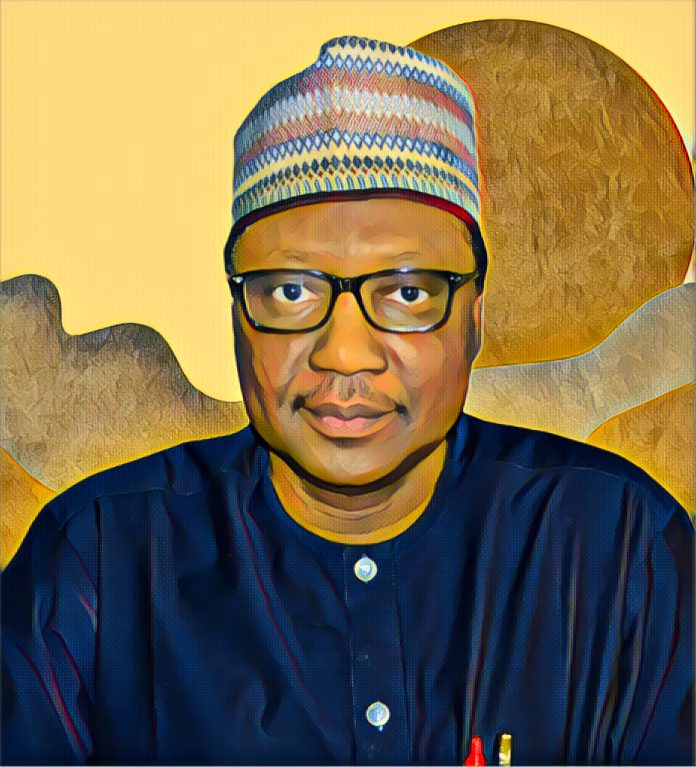

Mohammed Shehu, Chairman of the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC), revealed this information to Daily Sun in Abuja. The forthcoming report aims to break down the revenue allocation to all three government tiers, detailing deductions, collections, and disbursements.

Shehu added that they have already submitted the report to the president for review and approval.

Spotlight on Revenue-Generating Agencies

Commenting on the performance of various revenue-generating agencies, Shehu expressed that while some fell short of their targets, others, like the Federal Inland Revenue Service (FIRS) and Nigeria Customs Service (NCS), delivered commendably. Specifically, he applauded the FIRS for surpassing its set target for the year. However, he pointed out the Nigerian Upstream Petroleum Regulatory Commission’s (NUPRC) performance, which was somewhere between 43% and 53% of its target.

“The solid mineral sector is still in its early stages in terms of revenue contributions to the federation account. Its input is less than anticipated. Though the Customs showed promising performance, they couldn’t match the heights reached by FIRS,” Shehu observed.

Addressing the Subsidy Impact on West Africa

Shehu highlighted that Nigeria’s subsidy didn’t just affect its citizens but also influenced the entire West African region. Stressing the importance of the decision to remove subsidies, he said, “It was not only Nigeria that we subsidized but the entire West African sub-region. The consumption rate has now decreased by about 10%. Historically, around 30-40% of products from the Nigerian National Petroleum Corporation (NNPC) ended up in countries like Cameroon, Niger, and Benin.”

Concluding, Shehu emphasized that the subsidy removal would provide additional funds for essential projects in Nigeria, addressing significant issues like infrastructure deficits.