KEY POINTS

- SEC intends to employ blockchain for enforcing improved capital market regulatory measures.

- Blockchain technology provides financial transactions with advantages of security together with transparency alongside efficiency.

- Nigeria adopts global regulatory standards which helps to increase investor confidence in the financial market.

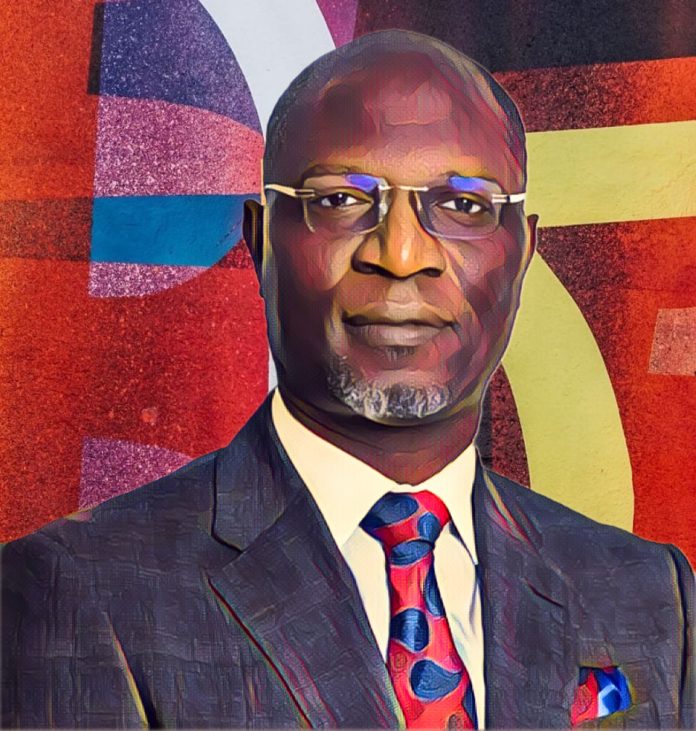

Dr. Emomotimi Agama as the Director General of Securities and Exchange Commission (SEC) declared that blockchain technology stands as a fundamental element to strengthen capital market regulation through its ability to boost efficiency and security together with transparency.

During his speech with the Algorand Foundation delegation in Abuja Dr. Emomotimi Agama explained how blockchain adoption would create a system for smooth financial market regulatory oversight.

The SEC describes blockchain as a decentralized transaction system that functions without centralized oversight yet enables multiple user groups to individually validate deal transactions.

Agama declared that the commission remains dedicated to adopting international industry standards by forging alliances with regulatory bodies such as the International Organization of Securities Commissions (IOSCO) to develop strong adaptable regulatory frameworks.

Blockchain technology to enhances both transparency and confidentiality standards

Agama presented SEC’s plan to merge blockchain technology into its regulatory operations with the dual objective to track deals instantly and strengthen market transparency.

The tamper-resistant traceable nature of blockchain allows detection and termination of fraudulent conduct making sure compliance reviews and checks on blockchain produce superior levels of accountability.

By using blockchain the SEC plans to shift capital market operations toward leadership in African financial sector technological advancements.