Nigeria is set to receive a $618 million fund from the African Development Bank (AfDB) to boost its digital and creative enterprises. The fund, which is part of the Investment in Digital and Creative Enterprise (i-DICE) initiative, aims to support young investors and entrepreneurs in the technology and creative sectors.

The i-DICE initiative was launched in March by former Vice President Yemi Osinbajo, who said it would help address the challenges of fundraising and access to markets faced by many start-ups in Nigeria. The initiative is co-financed by the AfDB, the French Development Agency (AFD), and the Islamic Development Bank (IsDB).

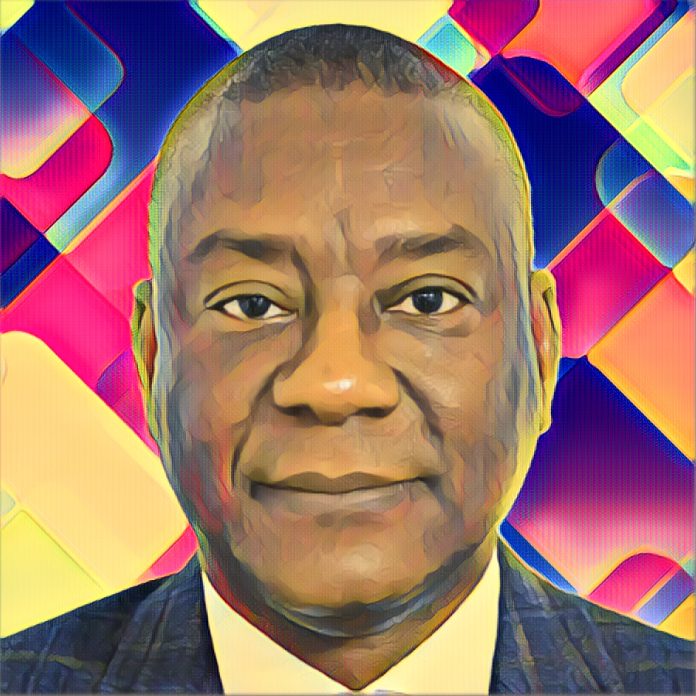

According to Mr Lamin Barrow, the Country Director-General for Nigeria at the AfDB, the Nigerian government is currently in the process of hiring a fund manager for the project. He told the News Agency of Nigeria (NAN) in Marrakesh, Morocco, on Sunday that the implementation of the project was delayed by the transition of government earlier this year.

He said the steering committee, chaired by the vice president and comprising members from various ministries, had met and received a briefing on the project. He added that the fund and the recruitment process for a fund manager would soon commence.

“The fund will be independently managed by the fund manager who will also contribute to the fund by supporting start-ups,” he said.

The i-DICE initiative is expected to create 65,000 start-ups in Nigeria, according to the French Minister, Catherine Colonnade, who visited Nigeria last week and signed the agreement for the co-financing. She pledged the support of the French government to the programme, noting that it would enhance the digital and creative potential of Nigeria.

The i-DICE initiative is part of the broader efforts by the AfDB and its partners to promote digital transformation and innovation in Africa. The bank has also launched the Africa Digital Financial Inclusion Facility (ADFI), which aims to provide 332 million Africans with access to digital financial services by 2030.

The AfDB believes that digital and creative sectors are key drivers of economic growth, job creation, and social inclusion in Africa. By investing in these sectors, the bank hopes to empower the youth, women, and rural communities, and foster a more resilient and sustainable recovery from the COVID-19 pandemic.

Source: Nairametrics