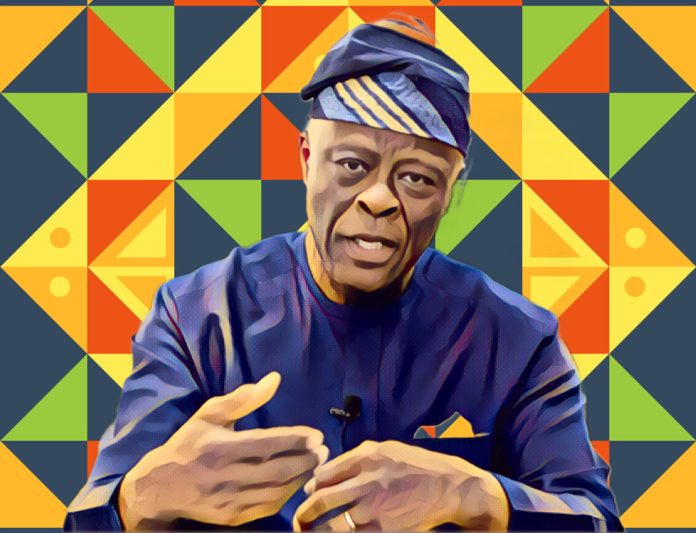

Finance Minister Wale Edun has outlined the Federal Government’s comprehensive approach to alleviating hardship and stabilizing the nation’s economy. In an insightful interview with Channels Television, Edun delved into various strategies aimed at addressing the increased cost of living, inflation, and ensuring food security, alongside collaborative efforts with the Central Bank of Nigeria on interest rates.

The backdrop to this conversation is a nation grappling with the consequences of significant economic reforms, notably the termination of fuel subsidies and the liberalization of the naira. These changes have sparked widespread protests and contributed to soaring food prices and general living costs. “The government was aware that these reforms would impact the cost of essentials like food,” Edun remarked, highlighting the anticipated inflationary pressures from these measures.

Central to the government’s response is a targeted relief effort for those most affected by the economic downturn. “President Bola Tinubu is committed to fulfilling his promises to the poor and vulnerable sectors of our society,” Edun emphasized. This commitment is manifested in a substantial intervention program that entails direct cash payments of N75,000, spread over three months, to 15 million households, potentially benefiting 75 million Nigerians. This initiative aims to directly address the reduced purchasing power and elevate the financial burden on families across the country.

Furthermore, Edun reiterated the government’s strategic move to release grains from the national reserves to combat the escalating food prices. “With an initial release of 42,000 metric tonnes and an additional 60,000 metric tonnes on the way, we are actively working to ensure food availability in the markets,” he stated. This measure is intended to provide immediate relief and stabilize food prices.

The conversation also touched on the contentious issue of fuel subsidy removal, which Edun noted was a significant financial drain on the nation’s resources, costing the government up to N400 billion monthly. “By removing the petroleum subsidy, we’ve not only safeguarded the government’s finances but also redirected those funds towards more impactful economic interventions,” he explained.

As Nigeria navigates through these economic challenges, Edun’s insights offer a glimpse into the government’s determined efforts to mitigate the effects of its necessary, albeit tough, economic reforms. By focusing on direct financial aid to households and ensuring food security through strategic grain releases, the government aims to cushion the adverse effects of inflation and the cost of living spike.

The collaboration between the Ministry of Finance and the Central Bank of Nigeria further emphasized a unified approach to managing interest rates and steering the country towards economic stability. As these initiatives unfold, the focus remains on supporting the nation’s most vulnerable populations while laying a foundation for sustainable economic growth.