Nigeria’s annual inflation rate has slowed for the first time in 19 months, bringing a measure of relief to the Central Bank of Nigeria (CBN). The inflation rate dipped to 33.4% in July 2024, down from 34.19% in June, according to data from the National Bureau of Statistics (NBS). This decline, although modest, is attributed to the high base effect from the previous year and marks a critical turning point in the country’s ongoing struggle with soaring prices.

The recent slowdown in inflation offers some respite after months of aggressive monetary tightening by the Central Bank. Since the beginning of the year, the Monetary Policy Committee (MPC) has raised interest rates by 800 basis points, bringing the rate to 26.75%. This series of hikes was aimed at combating persistently high inflation, which has placed a heavy burden on consumers and businesses alike.

July’s inflation data provides a mixed picture of the Nigerian economy. On one hand, the year-on-year (YoY) inflation rate’s decrease indicates that the CBN’s policies might be beginning to take effect. On the other hand, month-on-month (MoM) inflation also showed a slight reduction, with the rate easing to 2.28% in July from 2.31% in June 2024. This marginal decline reflects the ongoing challenges in controlling price increases, particularly in essential goods.

Tunde Abioye, a research analyst at FBNQuest, noted that while year-on-year inflation might continue to moderate slightly due to this effect, monthly inflation rates are likely to remain elevated in the near term.

“We expect to see a moderation, but it’s only due to high base effects from last year,” Abioye said. “On a month-on-month basis, inflation will still be a bit high. Overall, month-on-month inflation is likely to remain elevated, but year-on-year should start to taper down a bit due to base effects. We think inflation peaked in June/July, so we should begin to see some moderation going forward.”

Indeed, on a month-on-month basis, headline inflation in July 2024 slowed slightly to 2.28%, down from 2.31% in June 2024. While this reduction is small, it does suggest that inflationary pressures are not intensifying at the same rate as before, providing some hope that the worst may be over.

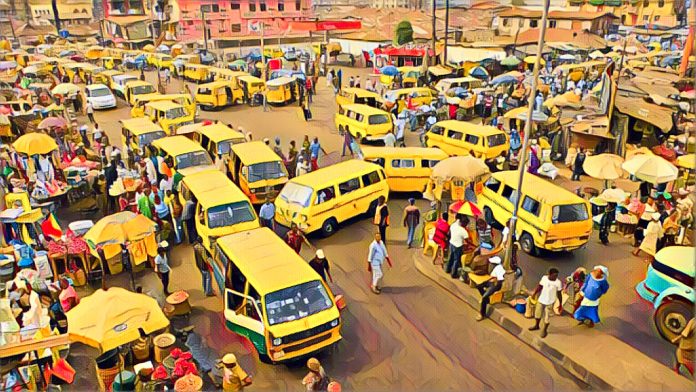

Food and non-alcoholic beverages continue to be the largest contributors to the year-on-year inflation rate, accounting for 17.30% of the total. This category is followed by housing, water, electricity, gas, and other fuels, which contributed 5.59% to the overall inflation rate. The high cost of these essentials has been a significant driver of inflation, affecting households across the country.

Core inflation, which excludes the volatile prices of agricultural products and energy, also saw an increase in July 2024. On a year-on-year basis, core inflation reached 27.47%, a substantial rise of 6.99 percentage points compared to the 20.47% recorded in July 2023. This increase highlights the underlying inflationary pressures that persist in the economy, even when volatile items are excluded.

Month-on-month, core inflation edged up to 2.16% in July 2024 from 2.06% in June 2024. The twelve-month average core inflation rate also rose, standing at 24.65% for the period ending in July 2024, up by 5.81 percentage points from the 18.84% recorded in July 2023. These figures suggest that while headline inflation is showing signs of slowing, core inflation remains a concern, driven by factors such as rising costs of goods and services.

One of the more positive developments in July 2024 was the slight decline in food inflation. The year-on-year food inflation rate was 39.53%, an increase of 12.55 percentage points compared to the 26.98% recorded in July 2023. However, on a month-on-month basis, food inflation slowed to 2.47% in July 2024, down from 2.55% in June 2024. This decline in food inflation is attributed to slower price increases for certain food items, including tinned milk, baby powdered milk, fresh fish, watermelon, and garri.

Despite the easing of food inflation, the high cost of staple foods remains a significant burden for many Nigerians. The rising prices of essential items like semovita, yam flour, and wheat flour continue to push food costs higher, increasing the challenges faced by households, particularly those in lower-income brackets.

Urban inflation in Nigeria also reflects the broader trend of slowing inflation. On a year-on-year basis, urban inflation in July 2024 was 35.77%, 9.94 percentage points higher than the 25.83% recorded in July 2023. Month-on-month, urban inflation stood at 2.46% in July 2024, slightly lower than the 2.46% recorded in June 2024. The twelve-month average urban inflation rate was 32.89% in July 2024, up by 10.02 percentage points from the 22.87% reported in July 2023.

In rural areas, inflationary pressures also showed signs of moderation. The rural inflation rate in July 2024 was 31.26% on a year-on-year basis, an increase of 8.77 percentage points from the 22.49% recorded in July 2023. Month-on-month, rural inflation decreased to 2.10% in July 2024, down from 2.17% in June 2024. The twelve-month average rural inflation rate was 28.86% in July 2024, up by 7.82 percentage points from the 21.04% reported in July 2023.