KEY POINTS

- Dangote’s net worth rebound is driven by the late-November dip.

- Stock gains in his cement business boosted his valuation.

- The refinery expansion tied to the focus keyphrase strengthens long-term revenue prospects.

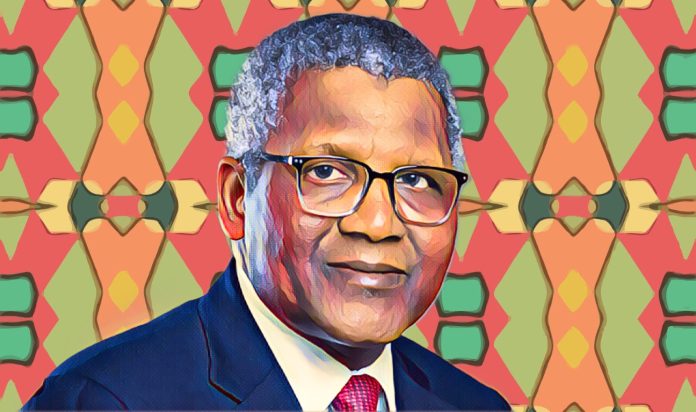

Africa’s richest man, Aliko Dangote, has clawed back the ground he lost during a sharp late-November dip, returning to a $30 billion fortune on the Bloomberg Billionaires Index.

His wealth had briefly fallen to $29.1 billion, but a fresh rally in his cement holdings has restored his lead over global peers and underscored the durability of his industrial portfolio.

Markets fuel the Dangote net worth rebound

Bloomberg’s real-time wealth tracker shows Dangote picking up $900 million in the past 15 days as renewed investor confidence lifted his publicly traded companies. Dangote Cement Plc, the crown jewel of his business empire and one of the most valuable stocks on the Nigerian Exchange, led the recovery.

The cement giant’s shares advanced 4.5 percent over the period, rising from N534.6 to N614.9. That push brought the company’s valuation to N10.2 trillion, lifting the value of Dangote’s 87.45 percent holding from $5.8 billion to $6.21 billion.

His year-to-date gain now sits at $1.89 billion, a reminder of how tightly his personal fortune is tied to the performance of his core industrial assets.

Refinery and fertilizer expansions accelerate

Beyond the equity markets, Dangote continues to extend his reach across energy and manufacturing. He recently sealed agreements in India aimed at boosting the capacity of his Lagos refinery to 1.4 million barrels a day.

According to Billionaires Africa, the pact with Honeywell Group provides licensing and engineering services for a new 750,000-barrels-a-day unit that will sit beside the existing 650,000-barrels-a-day facility, and it advances his ambition to reduce Africa’s reliance on imported fuel.

The conglomerate is also building its footprint in East Africa. Dangote appointed Engineers India Limited as project manager for a $3 billion expansion of his urea plant in Ethiopia, which will raise annual output to 3 million tons.

The announcements also come as Dangote Group explores raising about $5 billion for its refinery buildout, a plan that the African Export-Import Bank has said it is evaluating.

When completed, the Lagos complex could overtake India’s Jamnagar facility as the world’s largest refinery. Analysts project the operation will generate as much as $55 billion in annual revenue, strengthen Nigeria’s foreign-exchange reserves, and raise polypropylene production to 2.4 million metric tons.

The site’s planned 1,000-megawatt power capacity would further anchor its position as one of Africa’s most consequential industrial hubs.