Key Points

-

Nigeria oil mismanagement weakened industrial growth.

-

Palm oil rivals overtook Nigeria in global production.

-

Idle refineries blocked jobs and manufacturing industries.

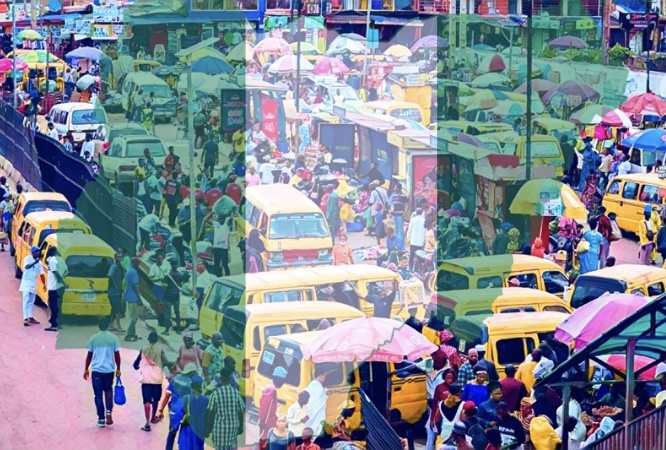

At 65, Nigeria’s economic story remains one of missed opportunities. The country, blessed with abundant resources, could have developed into an industrial powerhouse.

Instead, decades of Nigeria oil mismanagement and overdependence on crude revenue stalled manufacturing and deepened its reliance on imports.

Before the oil boom of the 1970s, Nigeria’s economy was largely agricultural. Cocoa from the West, groundnuts from the North, and palm oil from the East provided steady revenue streams.

Mining also contributed, with coal and tin making up significant exports. Remarkably, Nigeria was a net food exporter even during the Civil War between 1967 and 1970.

The tide turned after the 1973 Arab-Israeli War, which triggered a global oil price surge. Nigeria’s oil earnings skyrocketed, transforming crude into the backbone of its economy.

Agriculture and agro-allied industries were abandoned, while multinationals rushed in to set up factories for beer, cocoa drinks, pharmaceuticals, and even cars and trucks.

For a brief period, industrial estates in Lagos, Kano, Aba, Jos, and Kaduna buzzed with production.

Yet, this growth was fragile. When crude oil prices fell below $15 per barrel in the early 1980s, factories began shutting down.

The naira weakened against the dollar, purchasing power collapsed, and local industries could no longer compete.

What was once locally manufactured — from tyres to textiles, batteries to corned beef — was replaced by imports.

Nigeria had shifted from an aspiring industrial nation to one that depended on foreign goods.

Palm oil lessons from Malaysia and Indonesia

The story of palm oil captures Nigeria’s economic tragedy more vividly than any other sector. In the 1960s, Nigeria was the world’s largest exporter of palm products.

Researchers from Malaysia visited the country to collect palm seedlings and study Nigeria’s techniques.

Rather than rest on its leadership, Nigeria failed to invest in research, improved seeds, and processing industries.

Malaysia and Indonesia, in contrast, transformed palm oil into a multi-billion-dollar industry.

They diversified into over 70 palm-based products, ranging from cooking oil to cosmetics and industrial materials.

Today, the two countries account for 80 percent of global palm oil production and together earn more in annual palm oil revenue than Nigeria’s entire GDP.

Meanwhile, Nigeria slid into becoming a net importer of palm oil. Every administration since 1973 failed to correct this decline.

What should have been a foundation for industrial growth was squandered by poor planning and lack of foresight.

The loss of palm oil dominance illustrates how Nigeria repeatedly ignored opportunities to create value chains and manufacturing bases.

Instead of processing raw materials into industrial inputs, the country exported them cheaply and imported finished goods at higher costs.

Crude oil refining and the industrialization that never came

Crude oil, discovered in Oloibiri in 1956, should have been Nigeria’s launchpad for industrialization.

Refineries are more than just petrol and diesel plants; they are gateways to industries that rely on by-products like lubricants, plastics, waxes, and petrochemicals.

In countries with effective governance, refineries provide the raw materials for sectors ranging from construction to pharmaceuticals.

Nigeria built four refineries with the potential to fuel this growth. But corruption and mismanagement crippled them.

Today, nearly every refined petroleum product, from aviation fuel to bitumen, is imported.

The implications are stark: Nigeria not only spends billions annually on imports but also forfeits the job opportunities that local refining could create.

The absence of refining capacity has left regions like the Niger Delta underdeveloped.

Despite receiving 13 percent derivation from oil production, communities remain deprived of industries that could have emerged from by-product processing.

Instead of industrial clusters, the region is plagued by unemployment, pollution, and poverty.

As a result, Nigeria skipped the manufacturing phase that historically propels economies to prosperity.

It transitioned from an agrarian economy to a service and ICT-driven economy without developing a strong industrial backbone.

The result is a fragile system marked by high unemployment, weak infrastructure, and heavy reliance on imports.

The path Nigeria must take

Experts argue that Nigeria’s survival depends on correcting decades of oil mismanagement. Manufacturing must once again become central to the economy.

Nations that dominate global economic rankings — the United States, China, India, and Germany — are also leading manufacturers.

Without a strong manufacturing sector, Nigeria will continue to struggle with unemployment, poverty, and slow growth.

Reforms must focus on revitalizing agriculture, revamping refineries, and building industries that can transform raw materials into finished goods.

Nigeria has the human and natural resources to achieve this, but it requires discipline, transparency, and long-term vision.

Morita’s observation from the Harvard Business Review in 1992 still rings true: “Every economy can only be as strong as its manufacturing base.”

At 65, Nigeria must face this truth if it hopes to change its economic destiny.