KEY POINTS

-

The Nigerian presidency has intervened to clarify alleged discrepancies between passed and gazetted versions of new tax laws, following suspension calls from opposition leaders.

-

The head of the president’s tax reform committee attributes the controversy to a leaked draft document, asserting the final gazetted laws are authentic.

-

Despite the political dispute, the landmark reforms, which create a single revenue service, remain scheduled to take effect on 1 January.

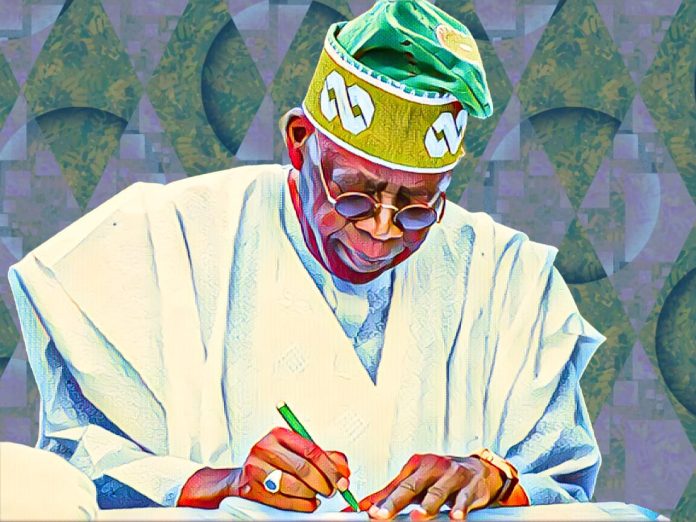

The presidency moved on Monday to address a growing political storm surrounding major new tax laws set to come into force on the first of January.

The intervention follows calls from prominent opposition figures, including former Vice President Atiku Abubakar and Labour Party’s Peter Obi, alongside civil society groups, demanding the laws’ suspension.

The controversy hinges on allegations of significant discrepancies between the versions of the tax bills passed by the National Assembly and the texts later officially gazetted.

The issue was brought to light by lawmaker Abdulsamad Dasuki, who claimed the gazetted laws did not reflect what was debated and approved on the floor of the House, breaching legislative due process.

Committee Chair Blames ‘Fake’ Draft for Public Confusion

Pushing back against the allegations, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, stated that much of the discussion has been based on inaccurate documents.

Appearing on Channels Television, Oyedele clarified that the official, harmonised bills sent to the President for assent are not in the public domain, making definitive comparisons impossible for outsiders.

“Before you can say there is a difference between what was gazetted and what was passed, we have what has not been gazetted. We don’t have what was passed,” Oyedele explained. He specifically addressed a contentious clause about a mandatory 20 per cent deposit, confirming it was in a draft gazette but is not present in the final, official version.

He attributed the circulation of the outdated draft to individuals who prematurely wrote a committee report before lawmakers had even met to review the matter.

The newly signed legislative package, described by the government as the most comprehensive tax overhaul in decades, establishes a unified Nigeria Revenue Service.

The reforms aim to simplify a notoriously complex system, widen the tax base, and eliminate duplicate levies across federal, state, and local tiers of government. Despite the current furore, the presidency has given no indication that the scheduled 1 January implementation will be delayed.