KEY POINTS

- Abdul-Aziz Yari becomes chairman and controlling shareholder of Geregu Power.

- Company stands to benefit from FG’s N4 trillion power sector debt settlement.

- Geregu Power recorded strong revenue and profit growth in 2025.

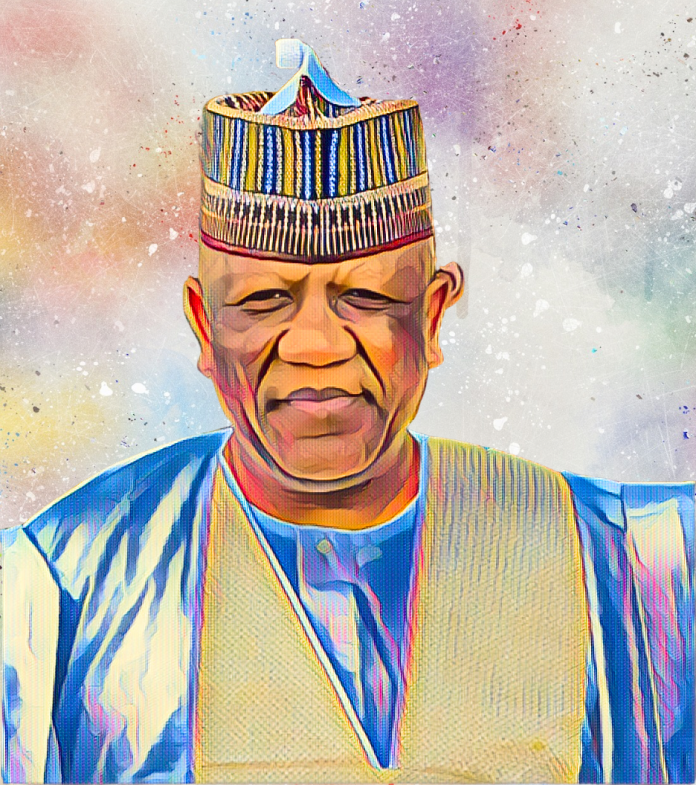

Nigerian businessman and former governor Abdul-Aziz Abubakar Yari has assumed a central role in the next growth phase of Geregu Power Plc, as his firm, MA’AM Energy Ltd, and other minority shareholders stand to benefit from a major settlement of power sector debts owed by the Federal Government.

The development comes as the government prepares to clear long-standing arrears to electricity generation companies (Gencos), with Geregu Power positioned among beneficiaries of a planned N4 trillion ($2.81 billion) bond-backed repayment framework.

Geregu Power within sector-wide bond settlement

According to Billionaires Africa, an analysis of power sector liabilities shows that Geregu Power is part of an estimated N4 trillion debt owed to Gencos through the Nigerian Bulk Electricity Trading (NBET) Plc. To address the backlog, the Federal Government has launched a bond programme under which NBET Finance Company Plc will issue bonds backed by a sovereign guarantee.

Geregu Power’s financial statements for the period ended September 2025 show receivables of about N170 billion ($116 million) after impairments. Before impairment, the figure could be as high as N500 billion ($341 million). By March 2025, companies owed the company an estimated N400 billion ($273 million), rising to nearly N500 billion by December.

Under the proposed settlement, Geregu Power and its shareholders are set to receive a significant portion of the N500 billion tranche allocated within the broader debt resolution framework.

Yari emerges as controlling shareholder

Yari’s rise at Geregu Power follows the exit of Nigerian billionaire Femi Otedola, who sold a 77 percent stake in the power generation company for $750 million. MA’AM Energy Ltd, a company linked to Yari, acquired the shares.

Furthermore, the company bought a 95 percent stake in Amperion Power Distribution Company Limited, the vehicle through which Otedola held most of his Geregu Power shares. The deal also effectively made Yari the new controlling shareholder of the listed power firm.

Subsequently appointed chairman, Yari takes over a company with strong recent financial performance. Geregu Power’s pre-tax profit grew 82 percent to N11.2 billion ($7.62 million) for the three months ending September 2025. Revenue also rose 37 percent to N43.8 billion ($30.2 million).

During the nine months, revenue rose to N131.5 billion ($89.46 million), while pre-tax profit rose to N37.5 billion ($25.51 million). Higher electricity generation and better prices drove the performance.

From education to energy leadership

Yari’s professional journey began outside boardrooms. He began his career as a teacher and then went into politics for more than 20 years. He has been a governor of a state and held other national political positions.

Yari has advanced degrees in public administration, finance, and investment management. He also has a master’s degree from the University of Salford and a certificate in Leadership and Change from the London School of Economics.

Beyond politics, he has steadily built MA’AM Energy Ltd as a private investment vehicle focused on energy solutions, with an emphasis on sustainability, reliability and efficiency. The acquisition of Geregu Power places him at the centre of one of Nigeria’s most closely watched corporate transitions.

Finally, with a new controlling shareholder, improving cash flow prospects from government debt repayments and rising profitability, analysts say Geregu Power is entering a pivotal phase. Yari’s leadership is further expected to shape the company’s expansion strategy as Nigeria’s power sector undergoes financial restructuring.