In a landmark ruling, the Supreme Court of Nigeria decided on Wednesday that the old and redesigned naira notes will remain valid legal tenders indefinitely.

The seven-member panel, led by Justice Inyang Okoro, stated that these notes should circulate until the Federal Government, in consultation with relevant stakeholders, decides otherwise. This decision follows an application by the Federal Government, led by Attorney-General Lateef Fagbemi.

The recent administration of President Bola Tinubu had reapplied to the Supreme Court, seeking an indefinite extension of the previous December 31 deadline.

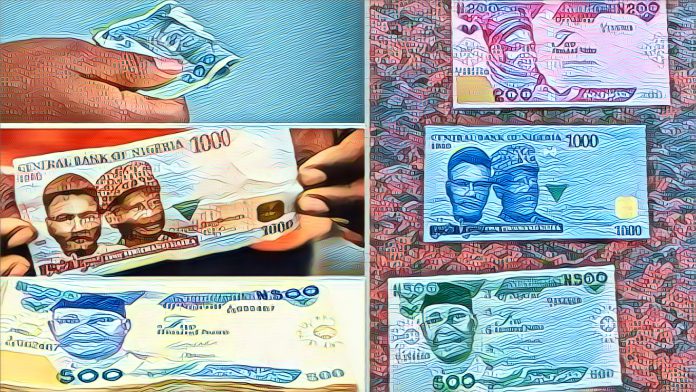

Justice Fagbemi, alongside Tijani Gazali, Acting Director of Civil Appeals at the Federal Ministry of Justice, presented the motion. The Court amended its earlier order, which set the end of December 2023 as the deadline, now allowing the old 200, 500, and 1000 naira notes to remain in circulation alongside the new designs.

The panel included Justices Uwani Aba-Aji, Helen Ogunwumiju, Ibrahim Saulawa, Adamu Jauro, Tijani Abubakar, and Emmanuel Agim. They collectively overruled the earlier decision to phase out the old notes by the end of the year.

Previously, on March 3, the Supreme Court invalidated the Muhammadu Buhari administration’s ban on the old naira notes. The court emphasized the need for these notes to coexist with the redesigned currencies until the year’s end.

Justice Agim, who delivered the lead judgment, criticized the Federal Government for not consulting the Council of States, the Federal Executive Council, the National Security Council, the National Economic Council, and other stakeholders before introducing this policy.

The Court found the government failed to provide adequate notice to federating units before withdrawing the old banknotes. It declared that a mere press statement by CBN Governor Godwin Emefiele did not constitute “reasonable notice” as required under section 20(3) of the CBN Act.

Furthermore, the Court invalidated President Buhari’s directive from a February 16 broadcast, which allowed only the old N200 note to remain legal tender until April 10. The apex court accused President Buhari of acting contrary to democratic governance principles by disobeying its interim order, which mandated the continued use of the old banknotes.

This ruling is significant for Nigeria’s economy, ensuring a smooth transition in currency circulation.