The Central Bank of Nigeria (CBN) has announced the successful completion of a sale of government securities, issuing over N1 trillion ($680 million) in short-term instruments. The sale, which took place on Friday, was part of the CBN’s liquidity management exercise, aimed at curbing inflation and stabilizing the exchange rate.

The CBN offered N500 billion ($340 million) at the Open Market Operations (OMO) auction, a market where the CBN sells or buys treasury bills to regulate the money supply in the economy. The offer was oversubscribed, as the CBN received bids worth N1.053 trillion ($680 million), indicating a high demand for the securities. About 79% of the total bids, or the equivalent of $530 million, came from foreign investors, according to a statement from the CBN.

The CBN said the result of the OMO auction underscored the level of confidence that the apex bank now enjoyed from investors, both local and international. The CBN also expressed optimism that its monetary policy measures were beginning to yield positive results, as it strives to support price stability and economic growth.

The OMO auction was the first since the CBN’s Monetary Policy Committee (MPC) meeting last week, where the CBN adopted a more aggressive tightening stance to address the persisting inflationary and exchange rate pressures. The CBN raised its benchmark interest rate, the Monetary Policy Rate (MPR), from 18.75% to 22.75%, the highest in Africa. It also increased the Cash Reserve Ratio (CRR), the percentage of deposits that banks must keep with the CBN, from 32.5% to 45%. The CBN also adjusted the asymmetric corridor around the MPR, the range within which it can lend or borrow from banks, from +100/-300 basis points to +100/-700 basis points. The CBN maintained the liquidity ratio, the minimum level of liquid assets that banks must hold, at 30%.

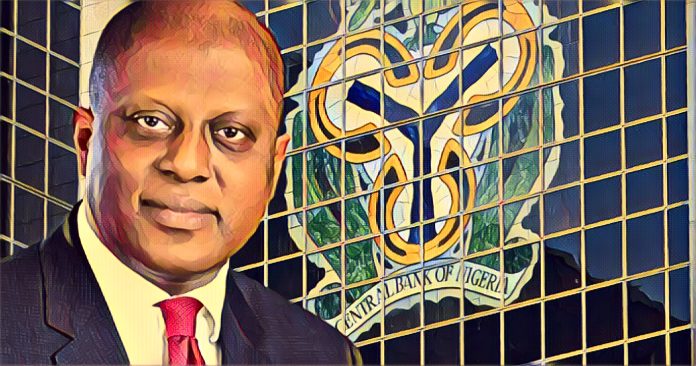

The CBN’s governor, Olayemi Cardoso, explained that these measures were necessary to rein in the inflation rate, which hit a four-year high of 17.33% in February, and to stabilize the exchange rate, which has been under pressure from the scarcity of foreign currency. Cardoso also said that the CBN was committed to increasing the foreign currency reserves, which stood at $35.4 billion as of March 1, and to improving the liquidity in the foreign exchange market. He assured that the CBN would soon clear the backlog of genuine foreign exchange transactions that have been pending due to the COVID-19 pandemic.

Cardoso also held a virtual meeting with foreign portfolio investors after the MPC meeting, where he outlined the CBN’s strategy and outlook for the Nigerian economy. He said the CBN was focused on building a fully functioning market that allows smooth entry and exit for investors, and that the CBN would continue to support the recovery and diversification of the economy, especially in the sectors of agriculture, manufacturing, and digital technology.

The CBN’s actions have been welcomed by some analysts and stakeholders, who believe that they would help restore confidence and stability in the Nigerian economy, which emerged from a recession in the fourth quarter of 2020, with a 0.11% growth rate. However, some critics have argued that the CBN’s tightening measures could stifle the growth momentum and hurt the poor and vulnerable segments of the population, who are already suffering from the effects of the pandemic and the rising cost of living.

As the CBN seeks to balance its dual mandate of price stability and economic growth, it also faces the challenge of ensuring the sustainability and inclusiveness of its policies, and of fostering a conducive environment for investment and development in Nigeria.

Source: Business Day